“In the stock market, the most important organ is the stomach. It’s not the brain.” ~ Peter Lynch

Bottom Line Upfront: Markets continue to be tormented by the U.S.’ increasingly emerging market-like public policy instability.

- We see the “Sell America” market reaction gaining momentum as pressure builds on the dollar, equities, and Treasurys.

- Recession risk in the S. is clearly elevated, with the combination of fiscal tightening, tariff shocks, and Fed hesitancy forming a toxic mix.

- The path for equities, especially large cap growth, remains lower over the coming We prefer exposure to gold and tangibles-related equities.

- We don’t see a resolution to the self-inflicted tariff panic anytime soon as this is now a political-ideology-driven move that won’t stop until we have a negotiated resolution, or something breaks.

As if the tariffs weren’t enough, the markets are now panicked by the potential removal of Jay Powell, a move that could trigger a Liz Truss-style bond market reaction in the U.S. The President’s messaging has awakened a “Sell America” market reaction with U.S. stocks, bonds and the dollar all declining. What’s unfolding resembles classic emerging market dynamics, with policy risk dominating and institutional credibility eroding. This has led to global diversification finally mattering again after being dormant for 15 years.

What seems clearer is that the fiscal dominant environment of the past several years has resulted in unsustainable deficit levels that need to be addressed.

Markets are no longer responding predictably to policy easing – a warning sign: The bond market is growing increasingly uncomfortable about rate cuts, as evidenced by the Fed’s 50 bps move in September that sent long bond yields higher, not lower.

Faced with costly tariffs, fiscal tightening and a reluctant Fed fearful of sticky inflation, the U.S. economy is flirting with a recession. While not a certainty, as tariffs can be negotiated to a manageable level and the Fed could re-engage to support the market, the risks have indeed risen over the last couple of months. The longer uncertainty persists for corporations, the greater the risks the economy jams up later this year.

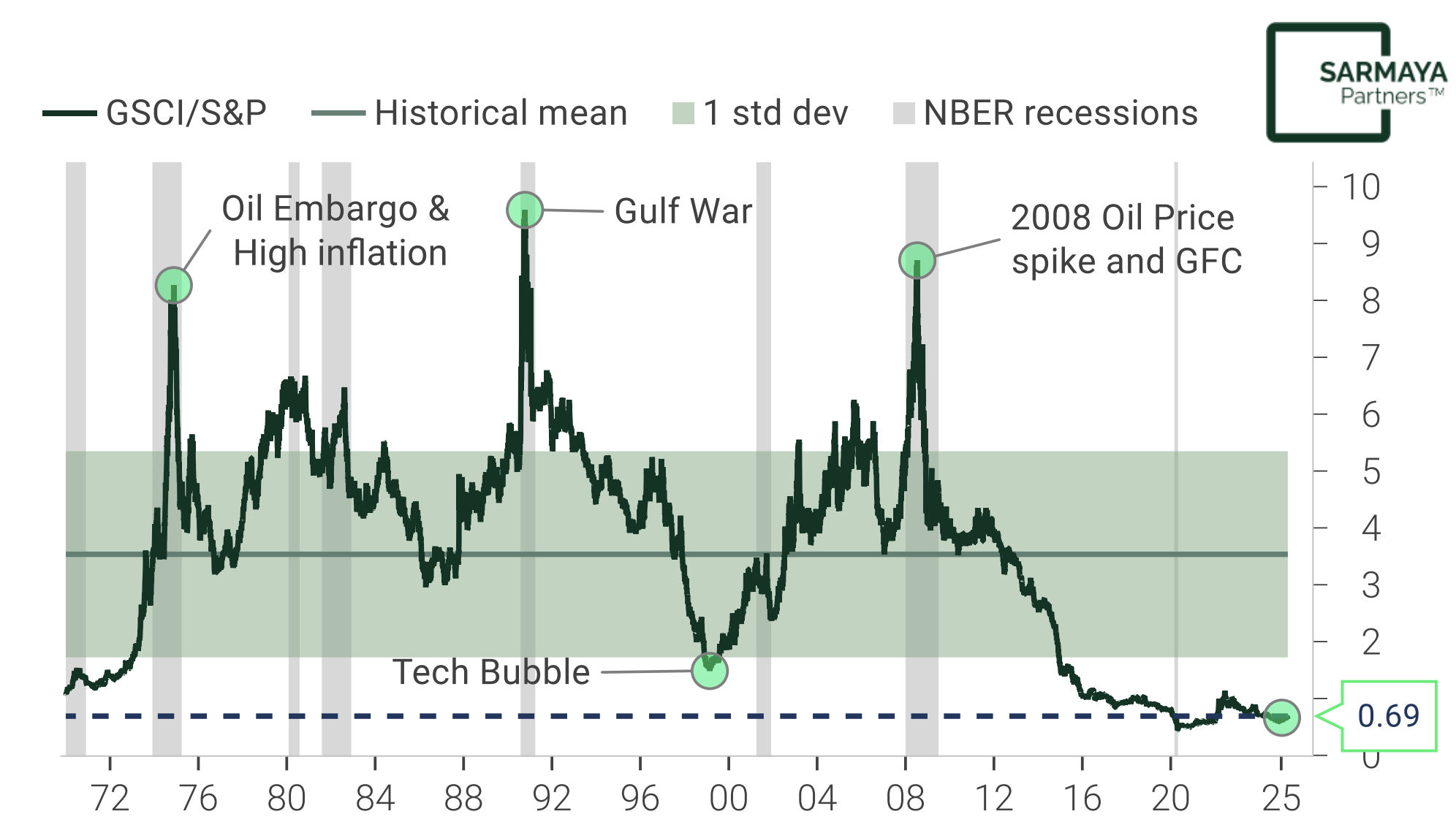

For risk assets, this spells trouble, especially for U.S. large cap growth stocks. With valuations still rich and macro risks rising, these names are likely to remain under pressure and the buy-the-dip crowd will continue to get burned as the path for the next several months is likely down. In the current environment, tangibles exposures in mining, oil, gas, copper and uranium in sectors like materials, energy and industrials, both in the U.S. and overseas are looking attractive. Especially since these areas have already priced in much of an economic slowdown and trade at valuations that provide somewhat of a margin of safety. Meanwhile gold, the King of the Tangibles, continues to march higher, reaffirming its role as the tier 1 geopolitical and haven asset it has been for millennia.

“In the stock market, the most important organ is the stomach. It’s not the brain.” ~ Peter Lynch

Bottom Line Upfront: Markets continue to be tormented by the U.S.’ increasingly emerging market-like public policy instability.

- We see the “Sell America” market reaction gaining momentum as pressure builds on the dollar, equities, and Treasurys.

- Recession risk in the S. is clearly elevated, with the combination of fiscal tightening, tariff shocks, and Fed hesitancy forming a toxic mix.

- The path for equities, especially large cap growth, remains lower over the coming We prefer exposure to gold and tangibles-related equities.

- We don’t see a resolution to the self-inflicted tariff panic anytime soon as this is now a political-ideology-driven move that won’t stop until we have a negotiated resolution, or something breaks.

As if the tariffs weren’t enough, the markets are now panicked by the potential removal of Jay Powell, a move that could trigger a Liz Truss-style bond market reaction in the U.S. The President’s messaging has awakened a “Sell America” market reaction with U.S. stocks, bonds and the dollar all declining. What’s unfolding resembles classic emerging market dynamics, with policy risk dominating and institutional credibility eroding. This has led to global diversification finally mattering again after being dormant for 15 years.

What seems clearer is that the fiscal dominant environment of the past several years has resulted in unsustainable deficit levels that need to be addressed.

Markets are no longer responding predictably to policy easing – a warning sign: The bond market is growing increasingly uncomfortable about rate cuts, as evidenced by the Fed’s 50 bps move in September that sent long bond yields higher, not lower.

Faced with costly tariffs, fiscal tightening and a reluctant Fed fearful of sticky inflation, the U.S. economy is flirting with a recession. While not a certainty, as tariffs can be negotiated to a manageable level and the Fed could re-engage to support the market, the risks have indeed risen over the last couple of months. The longer uncertainty persists for corporations, the greater the risks the economy jams up later this year.

For risk assets, this spells trouble, especially for U.S. large cap growth stocks. With valuations still rich and macro risks rising, these names are likely to remain under pressure and the buy-the-dip crowd will continue to get burned as the path for the next several months is likely down. In the current environment, tangibles exposures in mining, oil, gas, copper and uranium in sectors like materials, energy and industrials, both in the U.S. and overseas are looking attractive. Especially since these areas have already priced in much of an economic slowdown and trade at valuations that provide somewhat of a margin of safety. Meanwhile gold, the King of the Tangibles, continues to march higher, reaffirming its role as the tier 1 geopolitical and haven asset it has been for millennia.

Commodities at Historical Bottom Relative to S&P 500

Source: Sarmaya Partners; Macrobond

Gold Price since 1964

Source: Sarmaya Partners; Bloomberg

The next few months are likely to remain choppy as we go through the 90 day “wait and see” period on tariffs. Things could get even more rocky if the threat to terminate Powell isn’t walked back. If it materializes then a liquidity crunch is very much on the table, which could see a short-term US dollar bounce within the longer term weakened cycle.

With earnings season kicking into high gear amid the tariff tantrum, the outlook provided for the future will be more important than the results. Guidance will be increasingly important for investors as they gauge how companies are navigating the current uncertainty. However, if the macro policy continues to dominate investors’ attention, corporate earnings will likely not matter as much.

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

© 2025 Sarmaya Partners, LLC

April 21, 2025