Last December I wrote a paper titled, “1972 Market Partying Like It’s 1999.” With the flip-flopping tariff headlines, the administration’s “better-get-ready-forpain” rhetoric, and mixed economic data battering the markets, the question is: Is the party over or is this another buy-the-dip event among many since the Great Financial Crisis?

The truth about new market regime shifts, whether moving from bull to bear or vice versa, is that you don’t know you’re in it until it’s well underway. If this is the beginning of a long grind down market, it will only be realized in hindsight.

In a hyper-financialized economy, the market disruptions and negative earnings impacts from tariffs can be enough to derail asset prices, especially when the market is concentrated in a handful of names that are richly valued. We believe that the next bear market, yes there will be one eventually, will likely resemble the 2000-2002 bear market in its length, potential decline levels, and investor behavior.

Last December I wrote a paper titled, “1972 Market Partying Like It’s 1999.” With the flip-flopping tariff headlines, the administration’s “better-get-ready-forpain” rhetoric, and mixed economic data battering the markets, the question is: Is the party over or is this another buy-the-dip event among many since the Great Financial Crisis?

The truth about new market regime shifts, whether moving from bull to bear or vice versa, is that you don’t know you’re in it until it’s well underway. If this is the beginning of a long grind down market, it will only be realized in hindsight.

In a hyper-financialized economy, the market disruptions and negative earnings impacts from tariffs can be enough to derail asset prices, especially when the market is concentrated in a handful of names that are richly valued. We believe that the next bear market, yes there will be one eventually, will likely resemble the 2000-2002 bear market in its length, potential decline levels, and investor behavior.

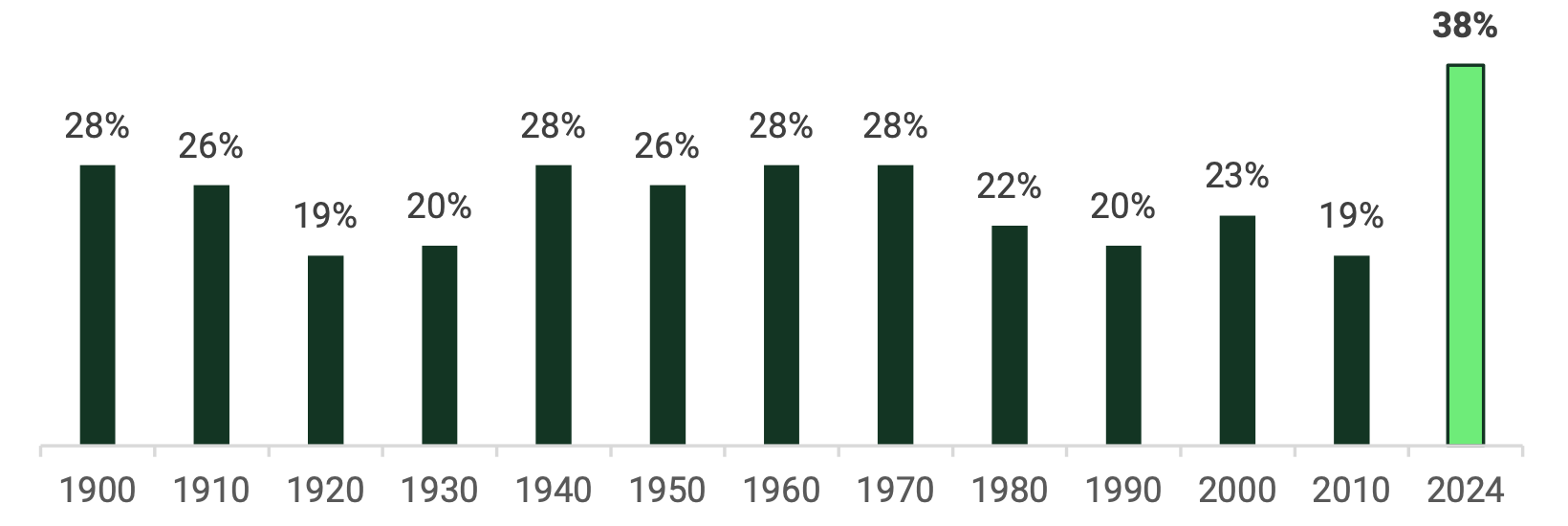

Top 10 Stocks as % of S&P 500

Cyclically Adjusted P/E Elevated

Sources: Sarmaya Partners; Citi (top chart); Robert Shiller (yale.edu; bottom chart)

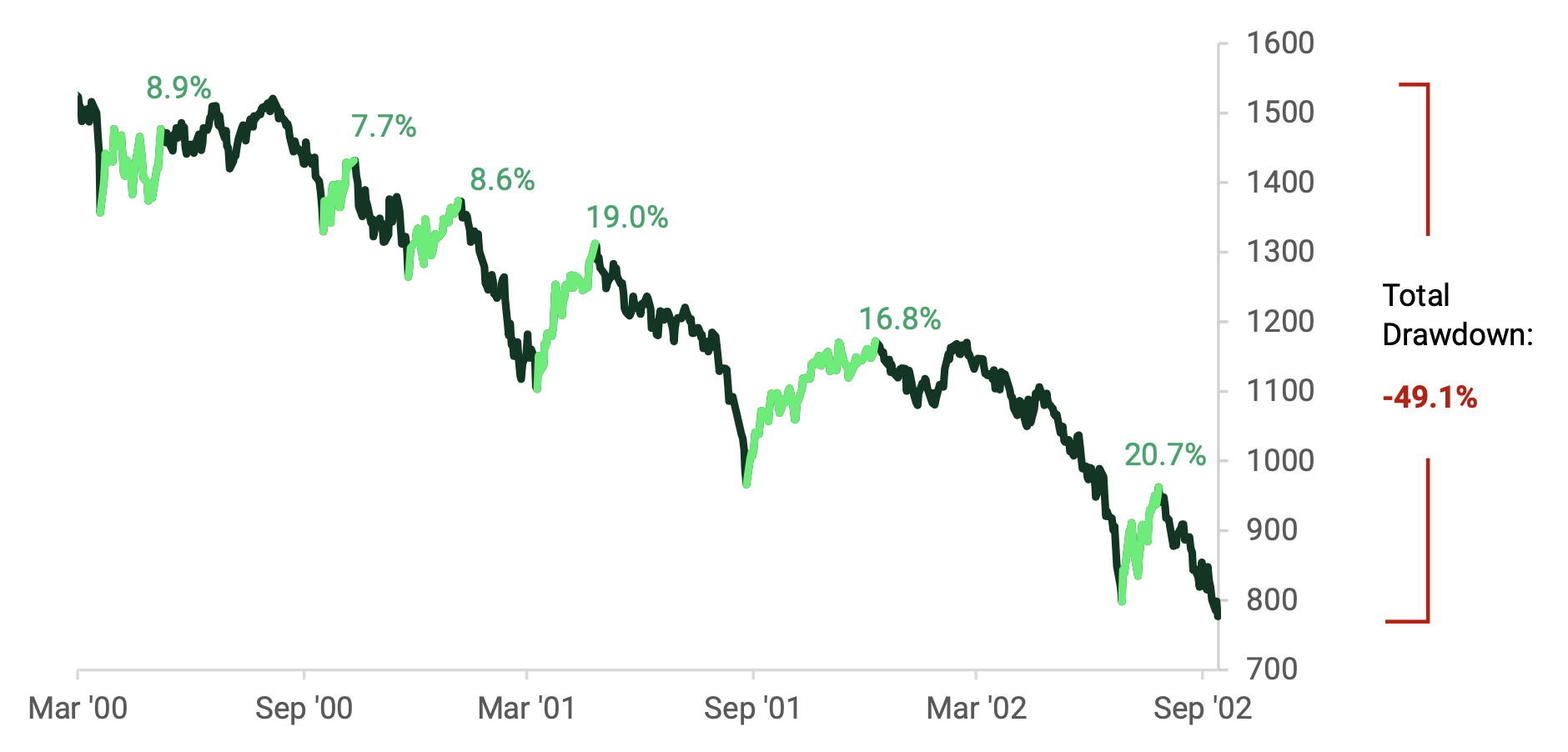

Those of us who managed money on the front lines during 2000-2002 can recall that it wasn’t like the GFC or Pandemic crisis. It wasn’t a bear market driven by a crisis or exogenous shock that plummeted the market suddenly and required the Fed and fiscal authorities to jump to the rescue. Instead, it was a market decline driven by slowing earnings growth under the weight of richly valued growth companies. It was a fundamentally driven Groundhog Day, death-by-a-thousand-cuts, slow grind bear market where earnings declined and valuations collapsed.

Over that period, investor psychology reluctantly shifted from “buy the dip” to “sell the rallies.” Eventually, it took over 15 years for the Nasdaq Index to get back to its prior highs

2000's Bear Market Rallies

(S&P 500)

Source: Sarmaya Partners; Bloomberg

Opportunities in Tangibles

It’s not all bad news, however. There are plenty of attractive areas in the market that have a margin of safety in the face of such a bear market, and are poised to become the leaders in the market recovery and into the next cycle.

Our thesis remains that the next big opportunity lies in what we’re calling the Return to Tangibles—sectors, regions and assets geared to commodities—led by gold, oil, gas, copper, and uranium among others.

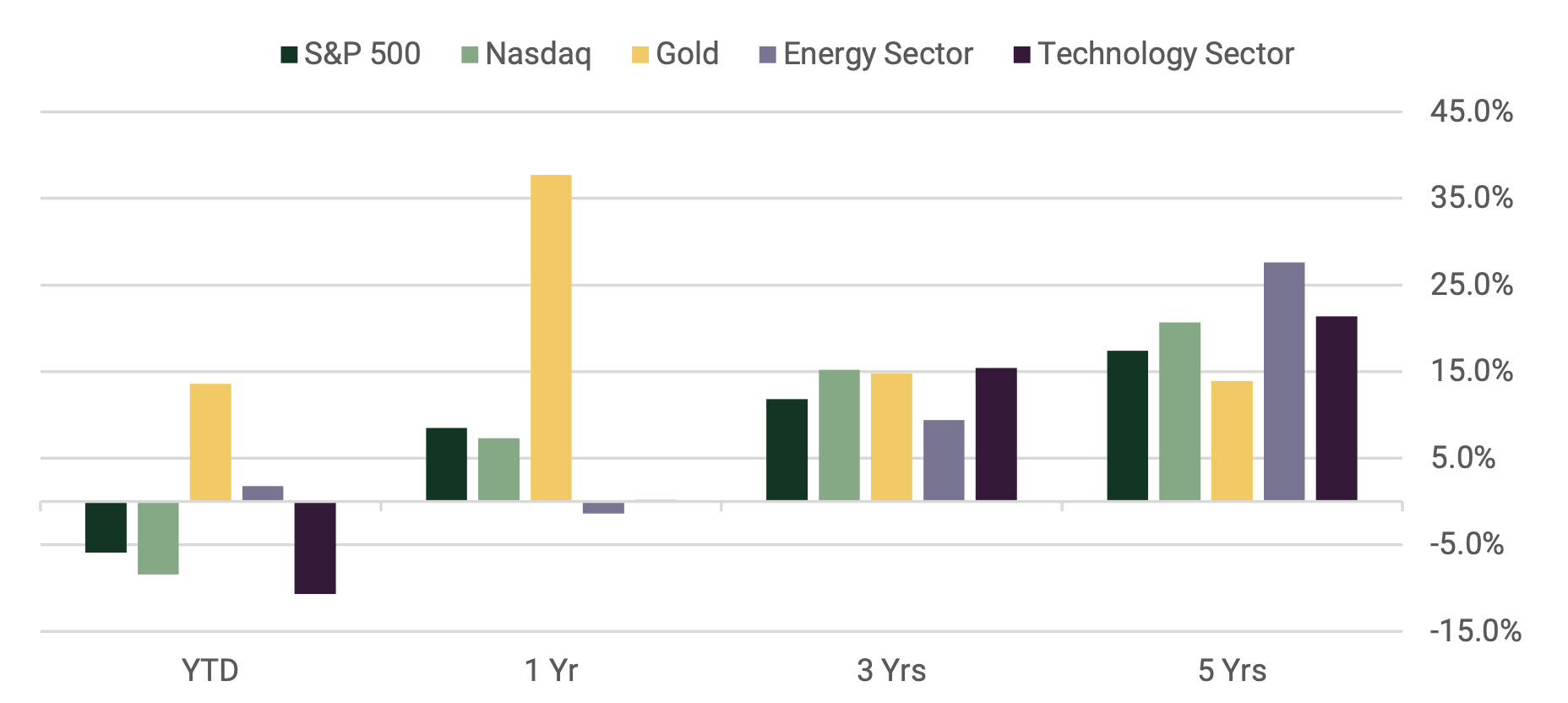

Investors may have been lulled into believing that diversification is dead as it has failed for over a decade, with U.S. Large Cap Growth consistently outperforming. That is understandable given the U.S. was the primary growth engine, driven by tech earnings and continued policy stimulus of one kind or another, in a world stricken by anemic growth.

In our view a secular shift, driven by policy changes and economic constraints, is underway where the opposite is likely to occur, and diversification will once again benefit portfolios. Tangible assets such as gold and silver as well as energy stocks have already been reflecting this coming sea change.

Secular Shift Beginning to Reflect in Returns

Source: Sarmaya Partners; Bloomberg; as measured by ETF performance

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

© 2024 Sarmaya Partners, LLC

March 14, 2024