“The present is the past rolled up for action, and the past is the present unrolled for understanding.” – Will & Ariel Durant

”History doesn’t repeat itself, but it often rhymes.” – Mark Twain

Note to Reader: Throughout this commentary, you’ll find titles of popular 1970s songs woven into the narrative as subtle “easter eggs.” They’re included both to lighten the tone and to echo the historical parallels we draw with that era. See if you can spot them all – or check the full list at the end.

Bottom Line Upfront:

Current macro conditions increasingly resemble the 1970s, suggesting a regime of structurally higher inflation and interest rates.

- History shows that this environment calls for a strategic portfolio rebalancing away from the “post-GFC to pandemic” playbook.

- In this environment tangibles sectors and commodities, especially gold, should benefit.

In the near term, slower growth and a potential recession may prompt disinflation and renewed Fed easing. However, given the macro backdrop of persistent fiscal deficits, an elevated government debt burden, and entrenched inflation expectations, in our view a return to Quantitative Easing (QE) would rekindle inflation and would be perceived by the market as an irresponsible act hurting U.S. government finances, limiting its effectiveness and putting downward pressure on the U.S. dollar.

More Than a Feeling

Our macro-led secular thematic investment approach is grounded in understanding history and combining that with policy options and constraints to identify opportunities. Even though the people, technology, and lingo are new in every era, the song remains the same.

We find some meaningful macro similarities in the current environment and the 1970s. Most notably:

- Persistent inflation

- Supply shocks

- Unsustainable fiscal situation requiring a reset

- Higher and rising interest rate levels challenging equity valuations

“The present is the past rolled up for action, and the past is the present unrolled for understanding.” – Will & Ariel Durant

”History doesn’t repeat itself, but it often rhymes.” – Mark Twain

Note to Reader: Throughout this commentary, you’ll find titles of popular 1970s songs woven into the narrative as subtle “easter eggs.” They’re included both to lighten the tone and to echo the historical parallels we draw with that era. See if you can spot them all – or check the full list at the end.

Bottom Line Upfront:

Current macro conditions increasingly resemble the 1970s, suggesting a regime of structurally higher inflation and interest rates.

- History shows that this environment calls for a strategic portfolio rebalancing away from the “post-GFC to pandemic” playbook.

- In this environment tangibles sectors and commodities, especially gold, should benefit.

In the near term, slower growth and a potential recession may prompt disinflation and renewed Fed easing. However, given the macro backdrop of persistent fiscal deficits, an elevated government debt burden, and entrenched inflation expectations, in our view a return to Quantitative Easing (QE) would rekindle inflation and would be perceived by the market as an irresponsible act hurting U.S. government finances, limiting its effectiveness and putting downward pressure on the U.S. dollar.

More Than a Feeling

Our macro-led secular thematic investment approach is grounded in understanding history and combining that with policy options and constraints to identify opportunities. Even though the people, technology, and lingo are new in every era, the song remains the same.

We find some meaningful macro similarities in the current environment and the 1970s. Most notably:

- Persistent inflation

- Supply shocks

- Unsustainable fiscal situation requiring a reset

- Higher and rising interest rate levels challenging equity valuations

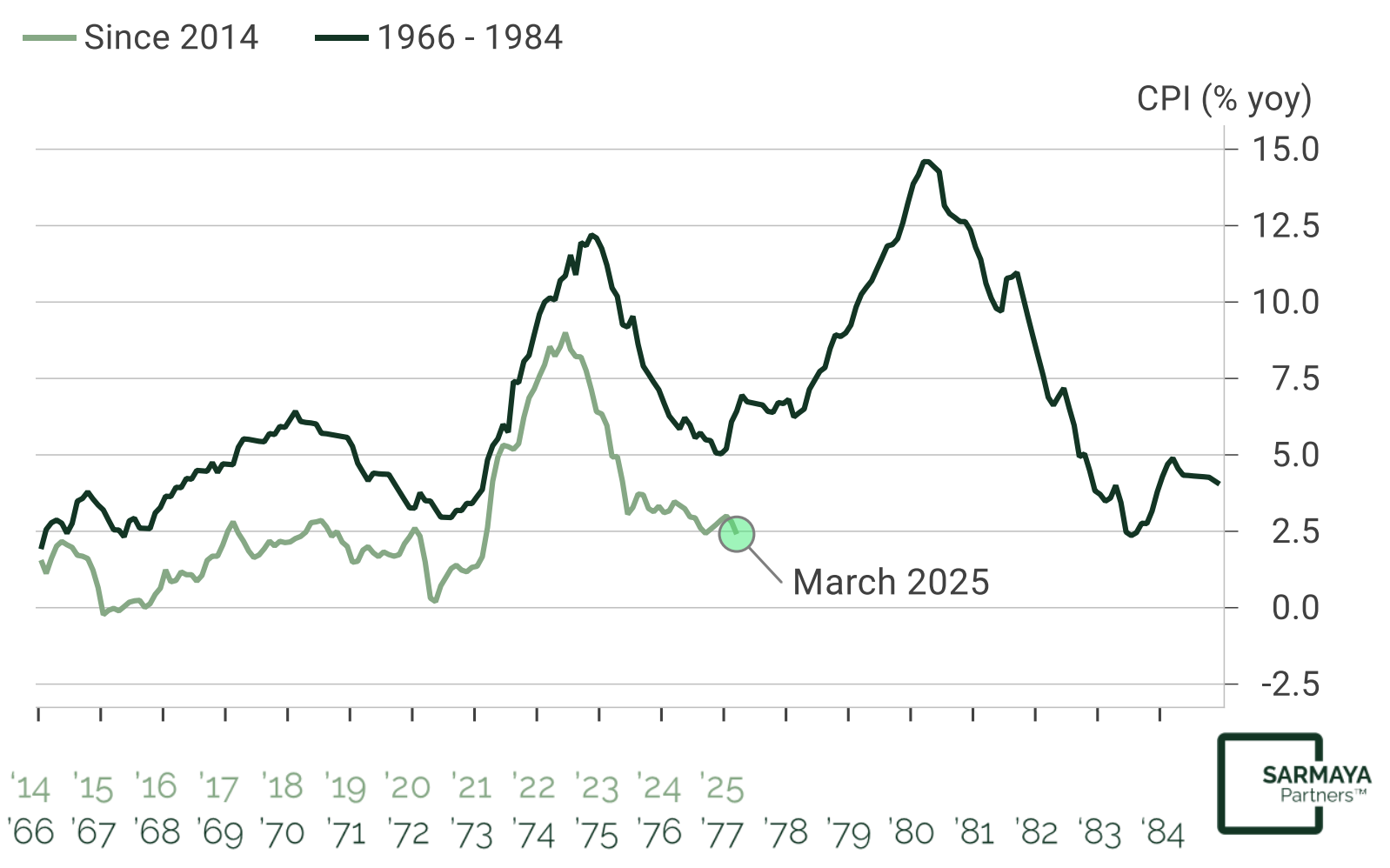

Inflation Remains Sticky

Inflation spikes don’t come in isolation. Like cockroaches, if there’s one, there’s usually more coming. The ’70s, like other inflationary eras, saw a series of inflation spikes, and we believe this time is not different. Even though its scale was much larger, the COVID pandemic stimulus spending looks akin to the late 1960s Guns and Butter spending plans – they might have helped the economy but sowed the seeds of inflation in the coming years.

Our view remains that the world crossed the Rubicon in 2021 and entered a new era of elevated inflation. If the monetary and fiscal stimulus during the pandemic was the kindling, then the supply chain-induced shortages were the spark that lit the inflation fire. Like earlier episodes in history, inflation isn’t dead and is quietly stayin’ alive until the next spike.

Inflation Trends Closely Resemble ’70s

Source: Apollo, Macrobond

The Fed is trying to hold the line and not cut interest rates despite the market and political pressures as it recognizes that inflation is still lurking in the economy. We expect the Fed to eventually reverse course as the economy weakens from the tariff impacts, an action that would rekindle inflation like the second wave in the ’70s.

Premature rate cuts or QE-like stimulus may also have London calling the bond market in a possible Liz Truss moment.

Supply and price shocks

The 1970s saw a series of supply and price shocks that created a succession of inflation spikes, leaving prices elevated as consumption shrank and interest rates climbed. The three primary shocks were the Bretton Woods system’s U.S. dollar gold peg ending in 1971, the OPEC oil embargo in 1973, and the Iranian Revolution in 1979.

Similarly, the pandemic supply chain breaks created an inflationary shock that, in our view, was the first in a series to potentially create a repeat of the ’70s succession of inflation spikes. To that end, tariffs are likely the next shock pushing inflation higher.

“Liberation Day’s” unexpectedly high tariff levels sent markets convulsing, with investors dazed and confused whether this was just an opening salvo in the “Art of the Deal” negotiations or the new normal for global trade. Despite the 90-day tariff hold, the increased uncertainty has effectively frozen trade and put many business plans on pause. The longer business hesitancy lingers, the greater the potential supply shock and price impact to consumer goods in the U.S.

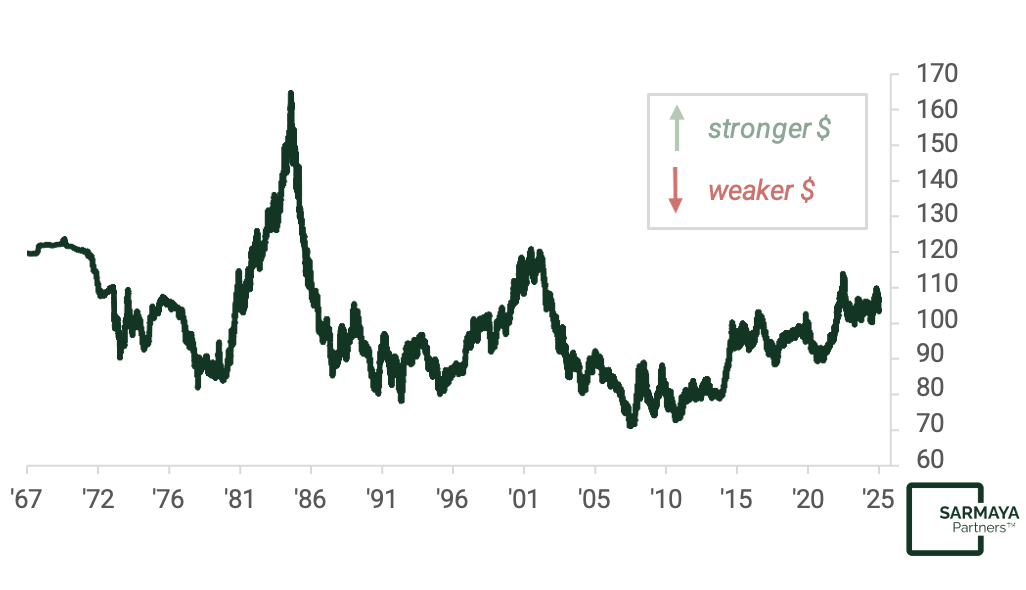

Monetary System Reset – End of Gold Peg vs. Tariffs

The ending of the gold standard in 1971 and the subsequent move to the petrodollar and fiat free-float-based monetary system is well documented. This was an important reset as the ability to maintain the gold peg was becoming unsustainable. The immediate impact of this change was an increase in inflation, although it wasn’t as drastic as the oil price shocks that came later. This new monetary system did create a slow, yet persistent, inflationary impulse in the economy. It also saw a declining U.S. dollar cycle through the remaining decade – this weak dollar cycle ended when the Fed started its fight on inflation and drastically raised interest rates.

Similarly, some would argue that the current monetary system of trade-deficit- driven recycling of U.S. debt is on an unsustainable path. The U.S. tariffs mark a new global trading era that will likely usher in a change to the current monetary system.

One of the effects of reducing the U.S. trade deficits will likely be a weakening U.S. dollar – an outcome the U.S. administration is targeting. This goal can also be achieved in a few ways. One is through a monetary reset such as a new currency accord. Another is through the escalation in geopolitical tensions leading foreign central banks to seek to diversify their U.S. dollar-heavy balance sheets into other assets such as gold. Lastly, America’s change in tone with long-standing allies such as Europe and Canada have also created a steady impulse of capital outflows as they recycle their assets away from U.S. assets and into domestic ones.

U.S. Dollar Index

Source: Sarmaya Partners, Bloomberg

Equity Market Comparison

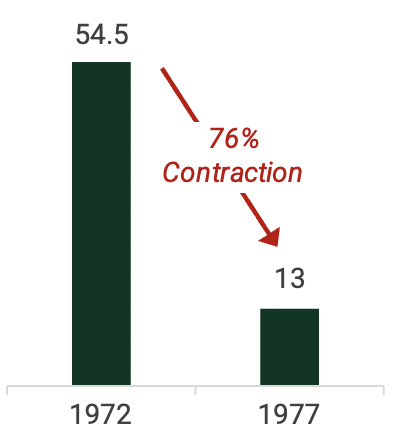

A small grouping of companies—the Nifty-Fifty stocks of the late 1960s—were considered rock-solid and were the leaders in customer reach through conglomeration, their footprints ever-growing, and their stock prices dominating the market.

Yet they weren’t infallible and born to run forever. The ensuing years revealed that they:

- Had been the beneficiaries of Fed easy money policies

- And were equally susceptible to the vagaries of inflation, rising rates, and the inevitable gyrations of the business cycle as many other businesses in history.

In the years after peaking around 1972, the Nifty Fifty stocks declined

significantly as they made way for the next market theme: a commodity super cycle led by gold and oil.

Nifty-Fifty: Median P/E

Nifty-Fifty: Individual Stocks’ Price Declines

Source: Forbes – 12/15/1977; Price Declines: Drawdown from High between 1972-1977 until 12/1977

Drawing Parallels with Today’s Market

While the “Magnificent 7” (Mag 7) stocks are only 7 companies, they represent a disproportionately large part of the market (>30% of the S&P 500’s current market cap) AND they are arguably behemoth global monopolies in their respective core businesses. Their impressive returns may have lulled investors to take it easy and see them as immune to economic cycles.

However, like the Nifty-Fifty, the Mag 7 companies are not immune to the ups and downs of business and market cycles. Yes, they may have strong balance sheets and hordes of cash, but investors haven’t been chasing up their stocks because of those attributes.

Their stocks have rocketed higher due to their earnings growth rates, as seen in their high stock multiples. Rising interest rates on the back of resurgent inflation and slowing earnings growth will likely act as the Kryptonite they always have for businesses, and the Mag 7 are no different.

Interest Rates & Equity Valuations

Source: Sarmaya Partners, Macrobond

However, don’t fear the reaper – it’s not all bad news. There are plenty of attractive areas in the market that have a margin of safety in the face of a bear market, and are poised to become the leaders in the market recovery and into the next cycle.

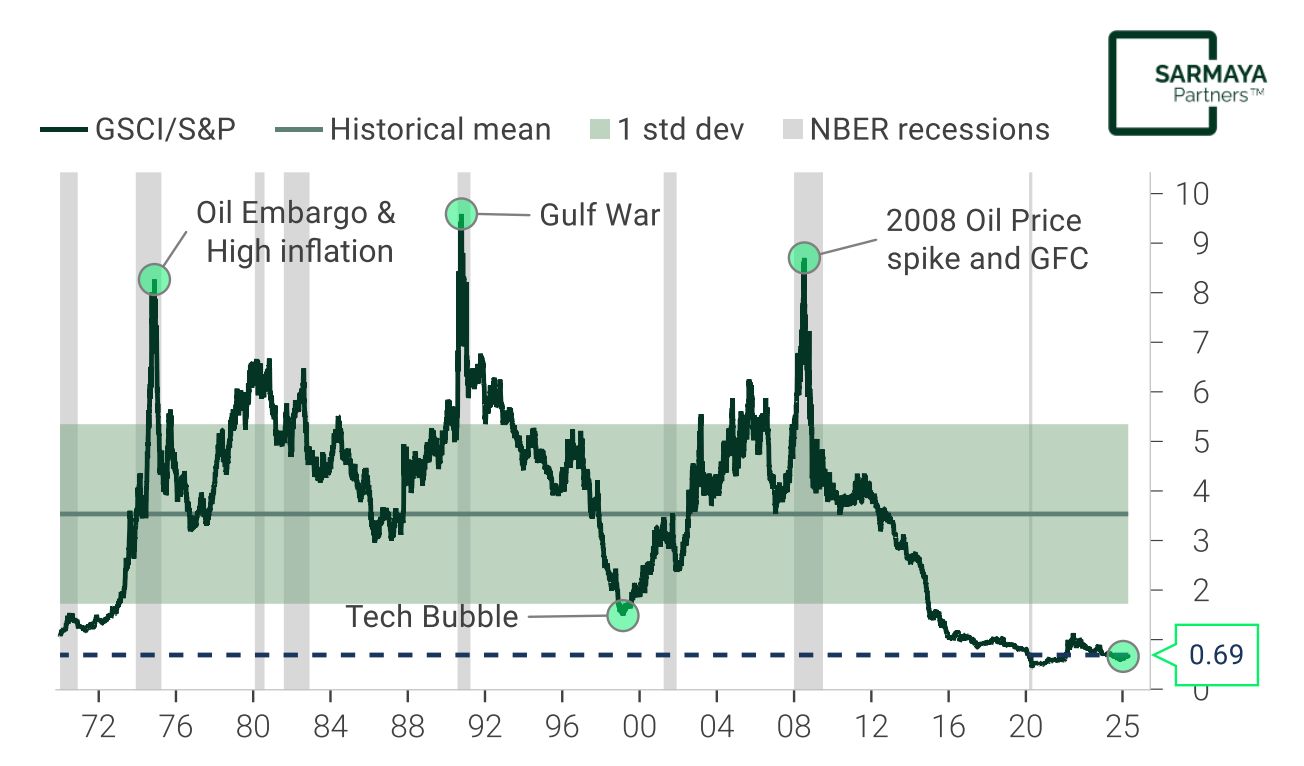

In our view a secular shift, driven by policy changes and economic constraints, is underway. Our thesis remains that the next big opportunity lies in what we’re calling the Return to Tangibles—sectors, regions and assets geared to commodities—led by gold, oil, gas, copper, and uranium among others.

Commodities at Historical Bottom Relative to S&P 500

Source: Sarmaya Partners, World PE Ratio; as of 07/31/2024

Gold Price since 1964

Source: Sarmaya Partners; Bloomberg

1970s Song References in This Commentary:

- “More Than a Feeling” – Boston

- “Take It Easy” – Eagles

- “Hold The Line” – Toto

- “London Calling” – The Clash

- “Born to Run” – Bruce Springsteen

- “Stayin’ Alive” – Bee Gees

- “Dazed and Confused” – Led Zeppelin

- “The Song Remains The Same” – Led Zeppelin

- “Don’t Fear the Reaper” – Blue Öyster Cult

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

© 2025 Sarmaya Partners, LLC

May 7, 2025