Investing in the Pillars of Economic Growth

Bottom Line Upfront: In our view, oil, natural gas, and uranium will remain at the center of energy affordability, reliability and security for much longer than the current consensus anticipates.

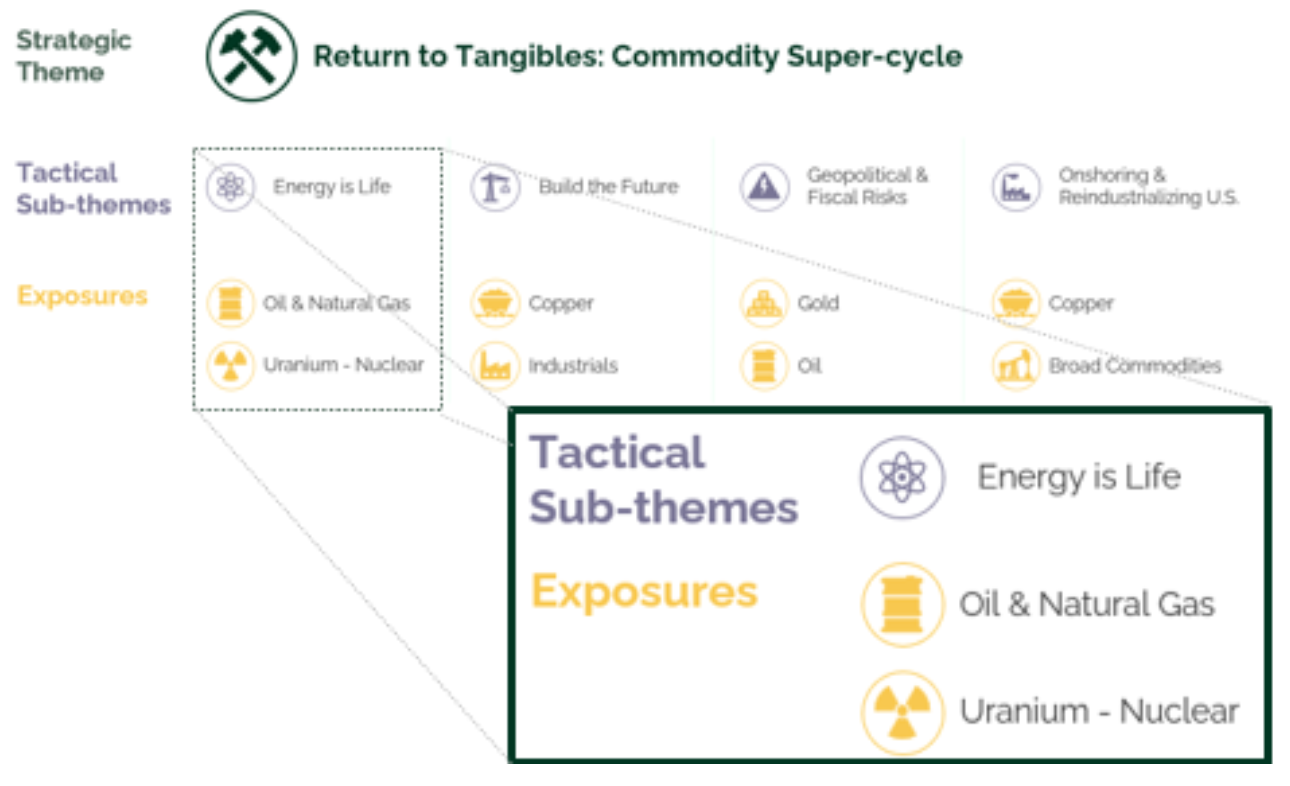

Abundant, cheap, and reliable energy serves as the foundation of societies’ prosperity and progress. Hence the name Energy is Life for a key sub-theme in the Return to Tangibles investment theme.

Investing in the Pillars of Economic Growth

Bottom Line Upfront: In our view, oil, natural gas, and uranium will remain at the center of energy affordability, reliability and security for much longer than the current consensus anticipates.

Abundant, cheap, and reliable energy serves as the foundation of societies’ prosperity and progress. Hence the name Energy is Life for a key sub-theme in the Return to Tangibles investment theme.

Key Takeaways:

- The traditional carbon-based energy space remains robust as demand continues to grow while supply discipline holds.

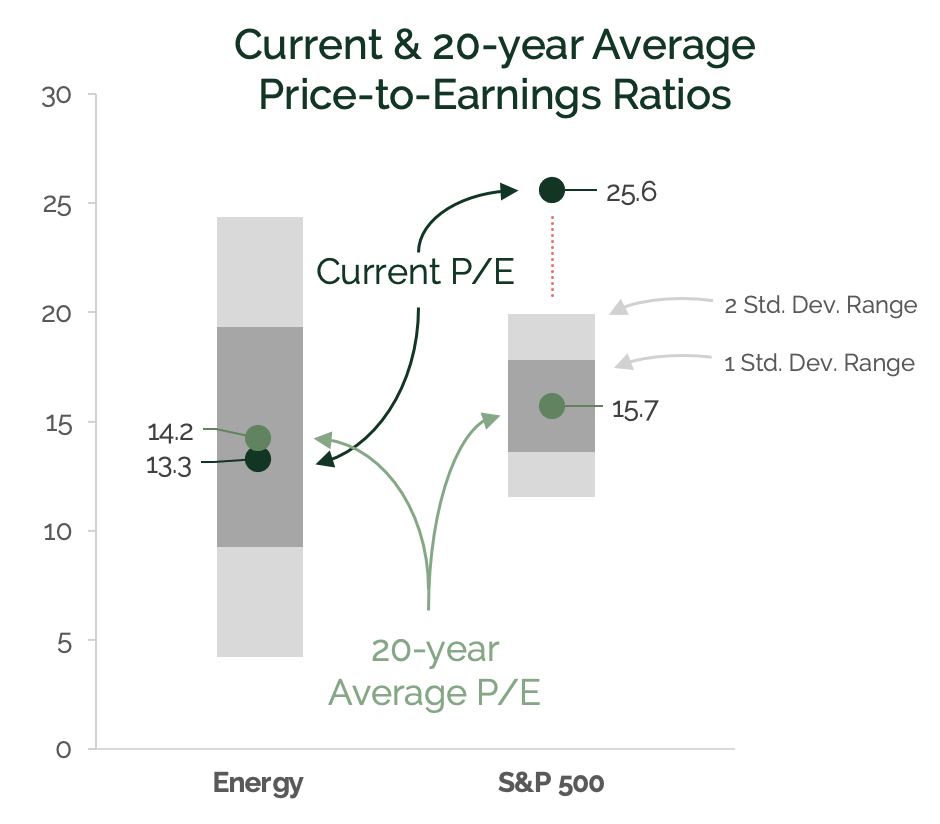

- Energy sector valuations relative to the market are attractive – for example, its price-to-earnings Ratio is the lowest of all 11 sectors.

- Nuclear energy is gaining recognition as the ultimate clean energy source and growing global plant construction should sustain the bull market in uranium.

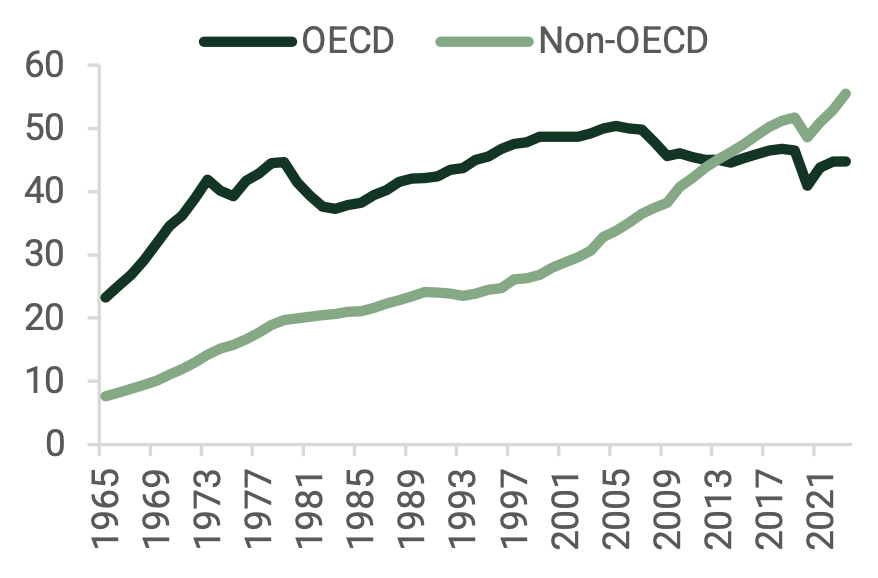

Energy is Life Sub-theme

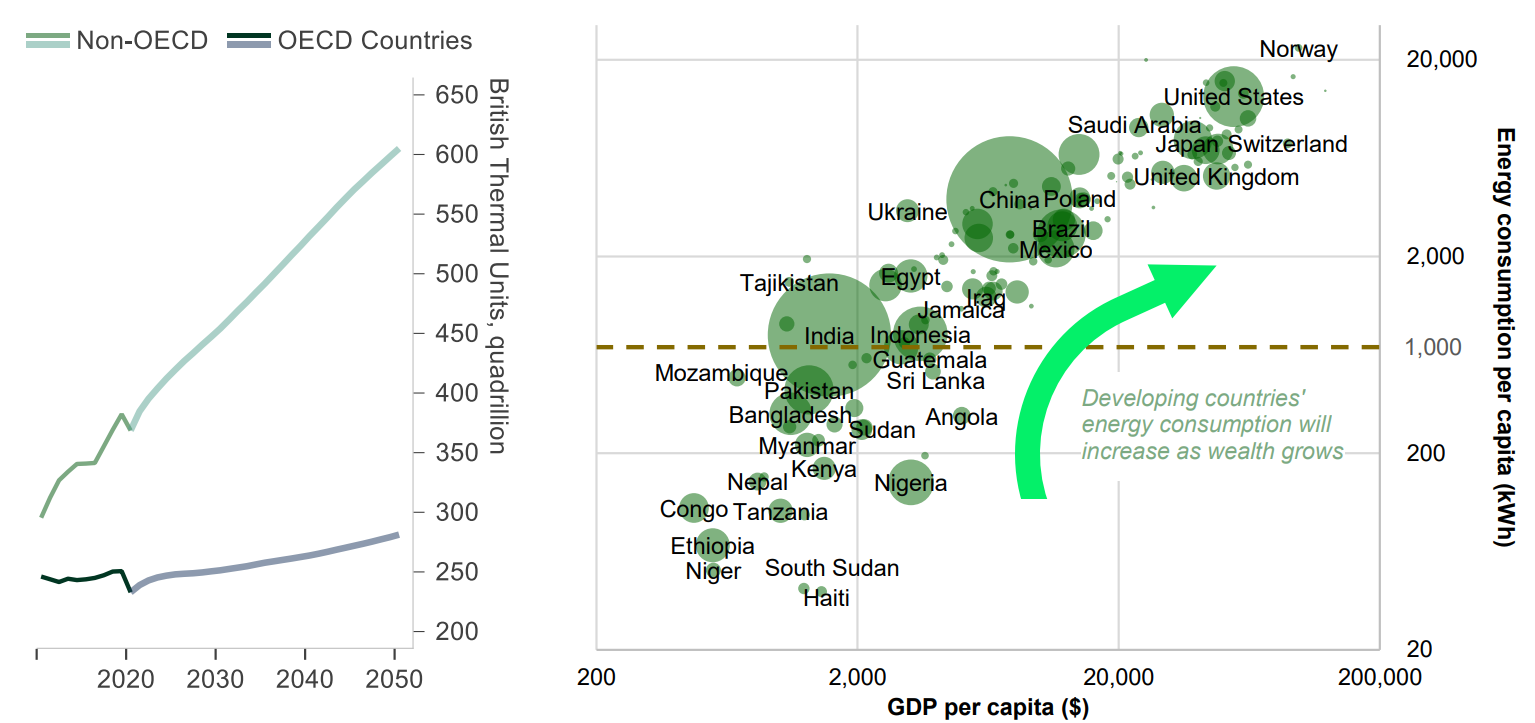

While it’s important to recognize that alternative energy solutions will continue to be part of the energy efficiency and emissions journey, the Energy Transition, as mapped out, is unrealistic in its timeline as well as in the mix-shift of narrow energy solutions. The current headline narrative is that for alternative energy to thrive, traditional energy must die. Yet, the reality, like most things in life, is more nuanced. The world’s overall energy consumption continues to grow, led by non-OECD economies like India and China, and traditional energy consumption continues to grow along with it.

In the search for efficient renewables, the world will be led back to nuclear as the ultimate source of clean and abundant energy, while the current alternatives’ inefficiencies and their reliance on subsidies and cheap cost of capital remain hindrances.

Global Energy Needs Far from Peak & Set to Outpace Supply of Renewables over Intermediate Term

Source: Sarmaya Partners, Macrobond, EIA Energy Consumption Estimate, World Bank

Oil & Gas

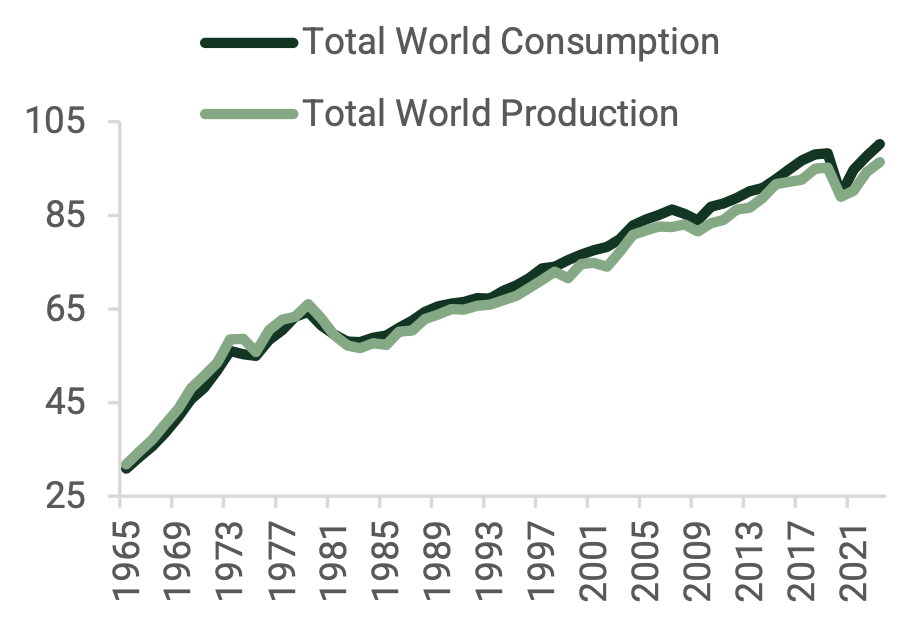

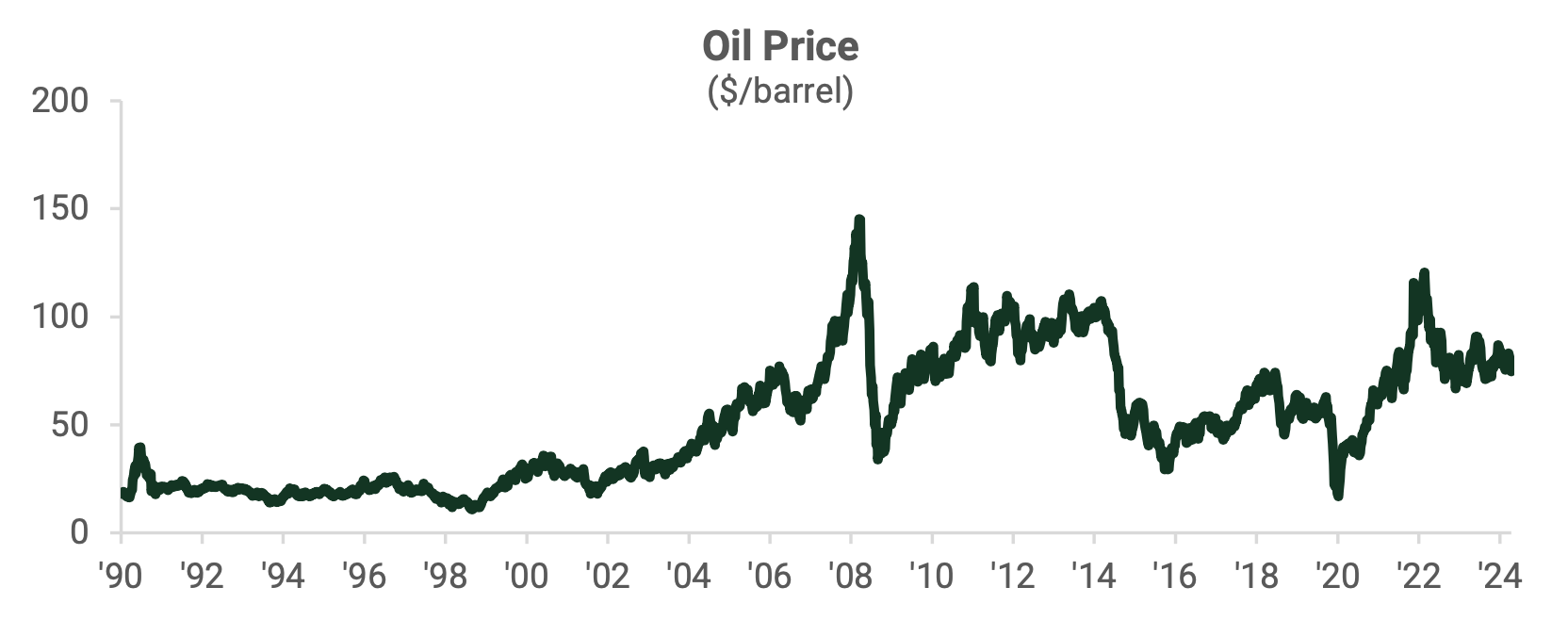

Fossil fuels were presumed to be on their deathbed when oil’s price went negative in the pandemic panic lows. Oil prices have recovered strongly since, reflecting stable and steadily growing global demand. Combined with Russia’s supply curtailment and the Saudi-led supply discipline from OPEC+, the oil market is displaying attractive investment fundamentals.

Additionally, M&A activity has increased in the sector in a sign of renewed optimism by the industry players. While the risk to oil prices would be a hard landing for the US economy, the relative valuation cushion for the equities, the demand from non-OECD outstripping OECD demand, and the ongoing geopolitical risks could provide a margin of safety relative to the broader market in our view.

Oil Production vs Consumption

Total Liquid Oils Consumption

OECD vs Non-OECD

Source: Sarmaya Partners, Energy Institute

Oil, despite being one of the ultimate foundational commodities, has gone through many boom and bust cycles, such as the recent bust in 2014-2020 and the current boom phase which started in 2021.

Source: Sarmaya Partners; Bloomberg

Underinvestment in the lean years was exacerbated by competition from alternative energy sources that were boosted by subsidies and cheap capital in the near-zero interest rate backdrop. These struggles, coupled with the rising impact of environmental (E of ESG) goals towards sustainability and a transition to alternative energy sources pushed the traditional energy sector into a perfect storm. The companies’ revenue had declined, and the market wasn’t interested in funding them.

The case for investing in the traditional energy space is the combination of cyclical growth-driven demand outstripping supply and attractive valuations fostering a bull market.

Source: Sarmaya Partners, World PE Ratio; as of 07/31/2024

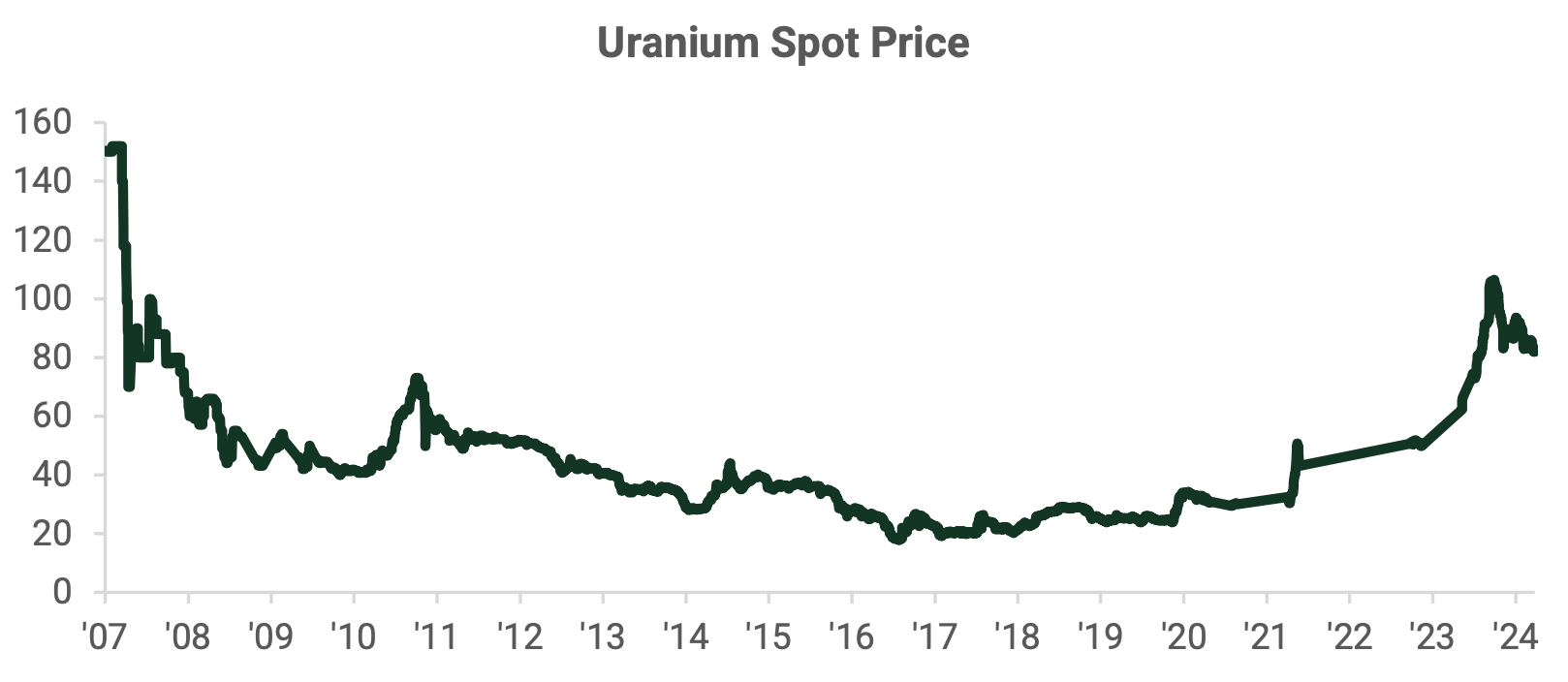

Uranium

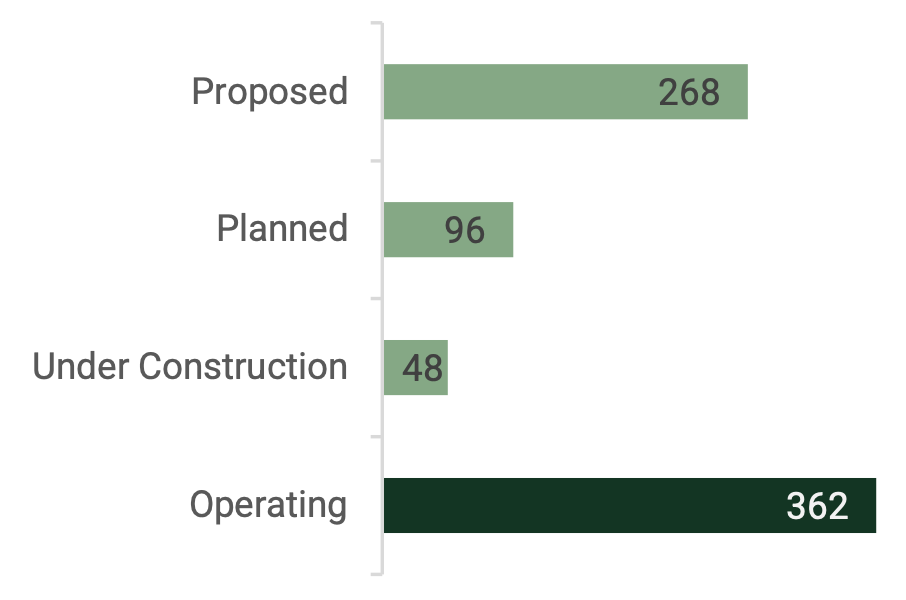

The search for non-fossil fuel solutions to meet demand and environmental challenges has brought nuclear power generation back to the fore. Utility companies and governments globally have been dusting off nuclear power generation plans and starting new projects. Nuclear power generation advancements, such as building smaller modular reactors, make these projects less daunting. The growth of these new projects will continue to push up uranium demand, of which the supply remains limited and takes a long time to bring on-line.

Source: Bloomberg, Sarmaya Partners

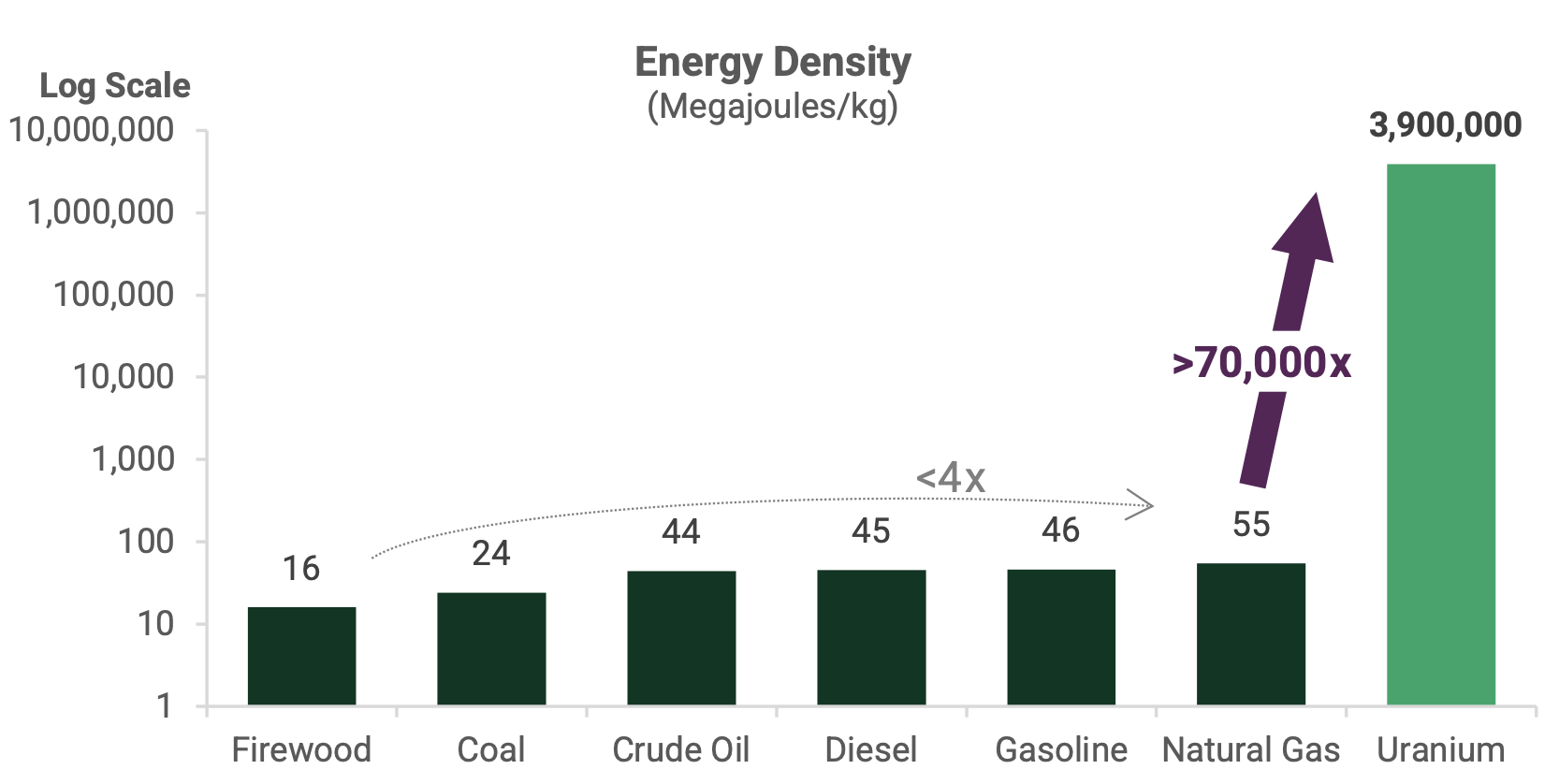

Nuclear is the cleanest and most efficient source of energy. The amount of energy that uranium (nuclear energy) can produce for 1 kilogram of input as compared to the other forms of conventional energy is off the charts, literally. The chart below uses a logarithmic scale in order for the efficiency numbers of the other energy sources to even show, as the order of magnitude increase for nuclear is tremendous.

To put it into relatable terms, 1 kilogram (kg) of firewood, on one end of the chart, produces around 16 megajoules (16 million joules) of energy. That’s enough to power a house for approximately 13 hours. A kilogram of uranium, on the other end of the spectrum, produces 3.9 million megajoules – enough to power a house for 3.2 million hours, or 365 years

(that’s not a typo).

Source: Sarmaya Partners, energyeducation.ca

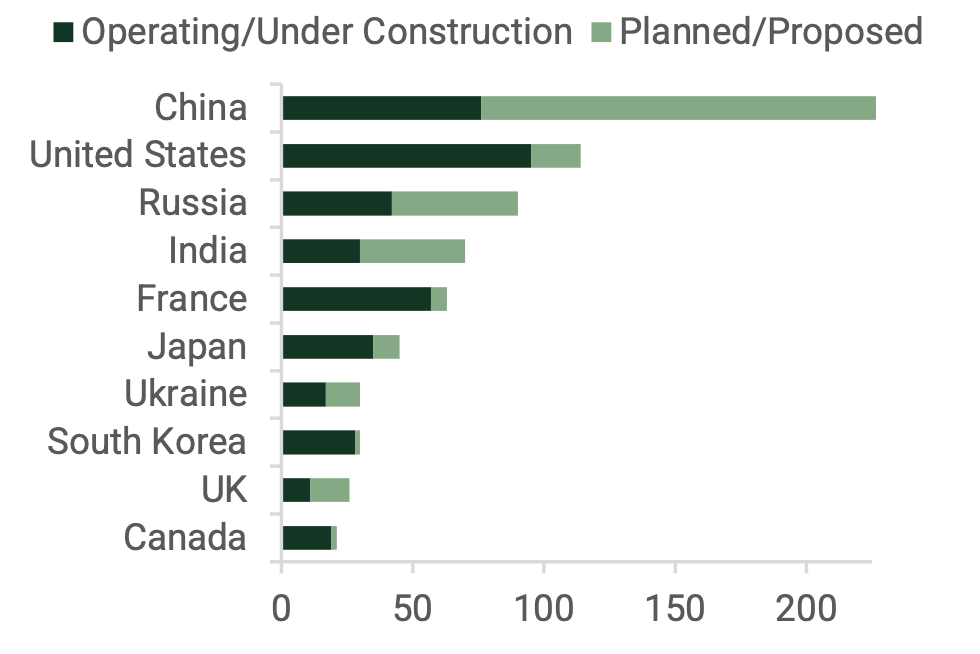

China is set to have the greatest number of nuclear power plants in the world – by a large margin. The most impactful energy transition would be China migrating its energy sources from coal to nuclear over time.

Number of Nuclear Reactors Set to More Than Double

Countries: Most Nuclear Reactors

Source: World Nuclear Association

Given nuclear power’s significant energy density and carbon footprint advantage, we expect China and the rest of the world to migrate more in its direction. The psychological safety concerns around and the “nuclear” name will need to be overcome through a greater understanding of the actual safety record. In our view, the necessity to utilize this energy source will incentivize big tech companies to step in and create innovative ways to not only harness the energy but also to work with government and help educate the public.

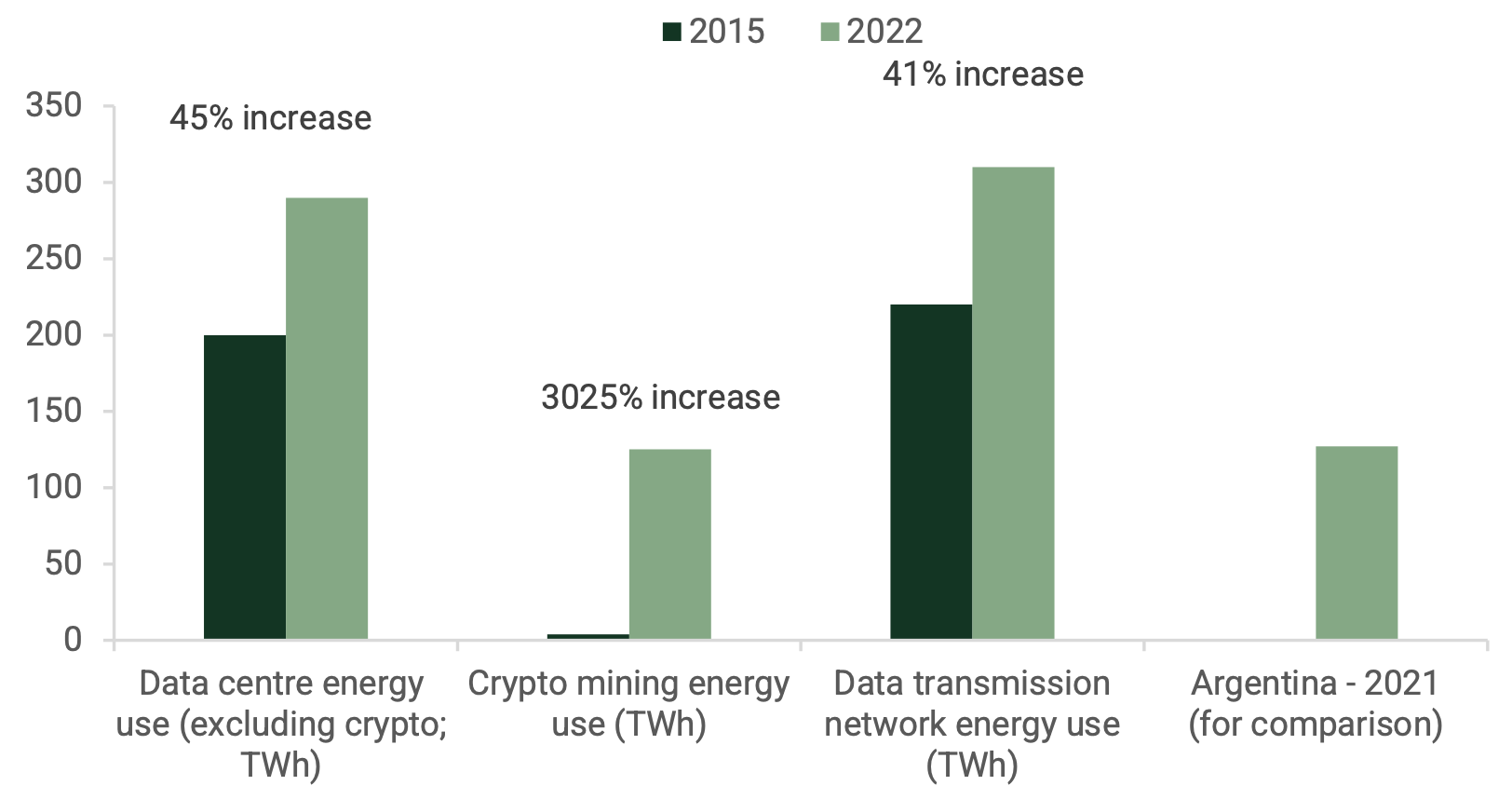

Expect Big Tech to Embrace Nuclear as Source of Clean Energy Amid

Artificial Intelligence (A.I.) Technology Revolution and Crypto Mining

Conclusion

Traditional energy, led by oil and gas, was seen as a declining source. Thepost-pandemic recovery and geopolitical escalations have shown otherwise. Given the attractive valuations in the oil and gas industry, the favorable supply and demand dynamics make the energy sector a leader in the new commodity super cycle. The anticipated energy transition will continue to get pushed out further as economic growth and national security interests will outweigh all other considerations. Renewables will likely be dwarfed by the ultimate clean energy source: nuclear.

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

© 2024 Sarmaya Partners, LLC

August 1, 2024