Shining Through Uncertainty

Bottom Line Upfront: Gold’s resurgence will be a key investment in the Geopolitical & Fiscal Risk sub-theme of the renewed Return to Tangibles commodity cycle.

Shining Through Uncertainty

Bottom Line Upfront: Gold’s resurgence will be a key investment in the Geopolitical & Fiscal Risk sub-theme of the renewed Return to Tangibles commodity cycle.

We expect Gold to:

- Regain importance amid higher inflation: As inflation remains elevated over the long term, gold will become increasingly crucial as a hedge.

- Serve as an alternative store of value: In a multi-polar world with rising geopolitical tensions, gold will be valued for the stability it can provide.

- Act as a safe haven: With developed nations facing significant fiscal risks, gold will provide a reliable haven to mitigate sovereign debt concerns

“All that is gold does not glitter,

Not all those who wander are lost;

The old that is strong does not wither,

Deep roots are not reached by the frost.

From the ashes a fire shall be woken,

A light from the shadows shall spring;

Renewed shall be blade that was broken,

The crownless again shall be king.”

― J.R.R. Tolkien

The Price of Gold Moves in Extended Cycles

Gold acts as a store of value in periods of higher inflation when fiat (paper) money is losing its purchasing power and real interest rates (interest rates minus inflation) are declining or in negative territory. It is also seen as a safe haven in times of elevated geopolitical environments. As we laid out in our Return to Tangibles paper and below, we crossed the Rubicon into a period of both risks in 2021-2022.

“And some things that should not have been forgotten were lost. History became legend. Legend became myth.”

– J.R.R. Tolkien

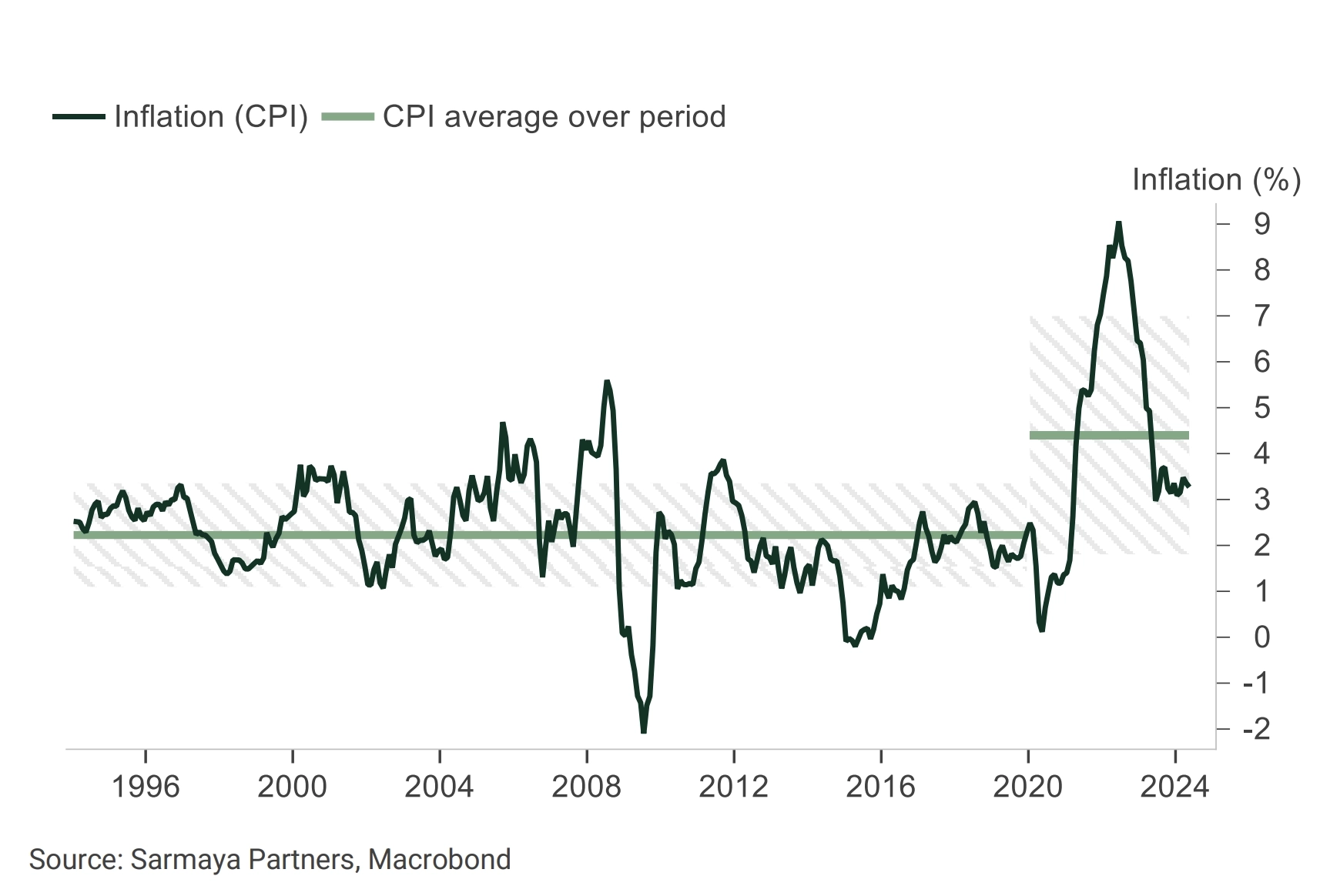

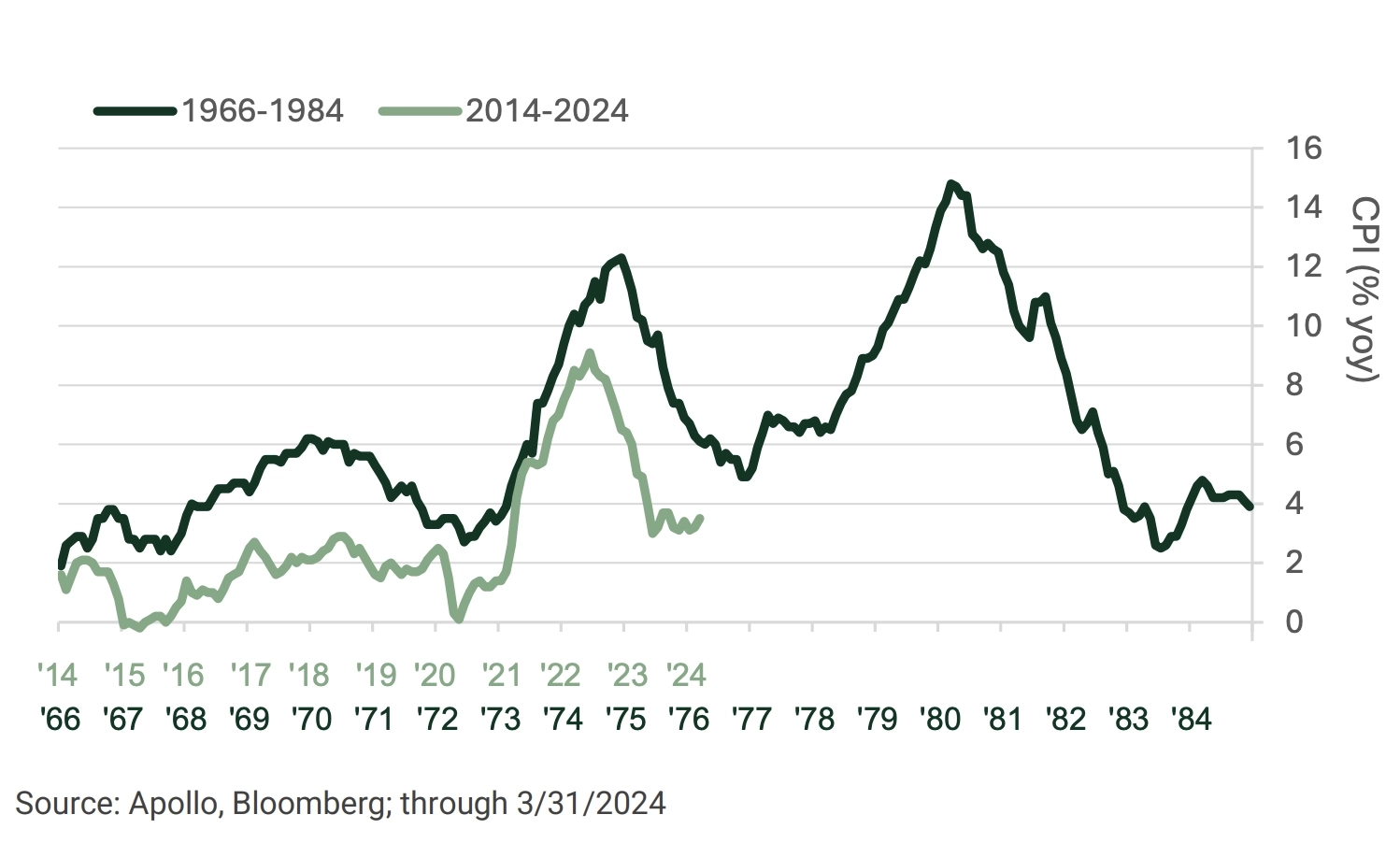

Era of persistently elevated inflation has only just begun

Current Inflation Pattern Reminiscent of the 1970s

Fed No Longer “The Only Game in Town”

Paradigm Shift: Monetary Stimulus to Fiscal Dominance

While the Fed was focused on fighting the “last war” against deflation, and its “team transitory” saw inflation in 2021 as temporary, the fiscal side of the ledger significantly contributed to stoking inflation. Wartime-level fiscal stimulus, deployed since 2020, continues to support the U.S. economy.

Although the Fed finally began addressing inflation in the summer of 2022 and has maintained discipline in keeping rates higher for longer, its efforts have been undermined by continued fiscal stimulus. Government spending acts such as the CHIPS & Inflation Reduction Acts, and the U.S. Treasury’s funding activities provide ample liquidity, counteracting the Fed’s Quantitative Tightening. This marks a major paradigm shift – the market and economy moving from monetary dominance to fiscal dominance. In other words, while the Fed is trying to curb inflation by draining the punchbowl, the government is refilling it, thus feeding inflation.

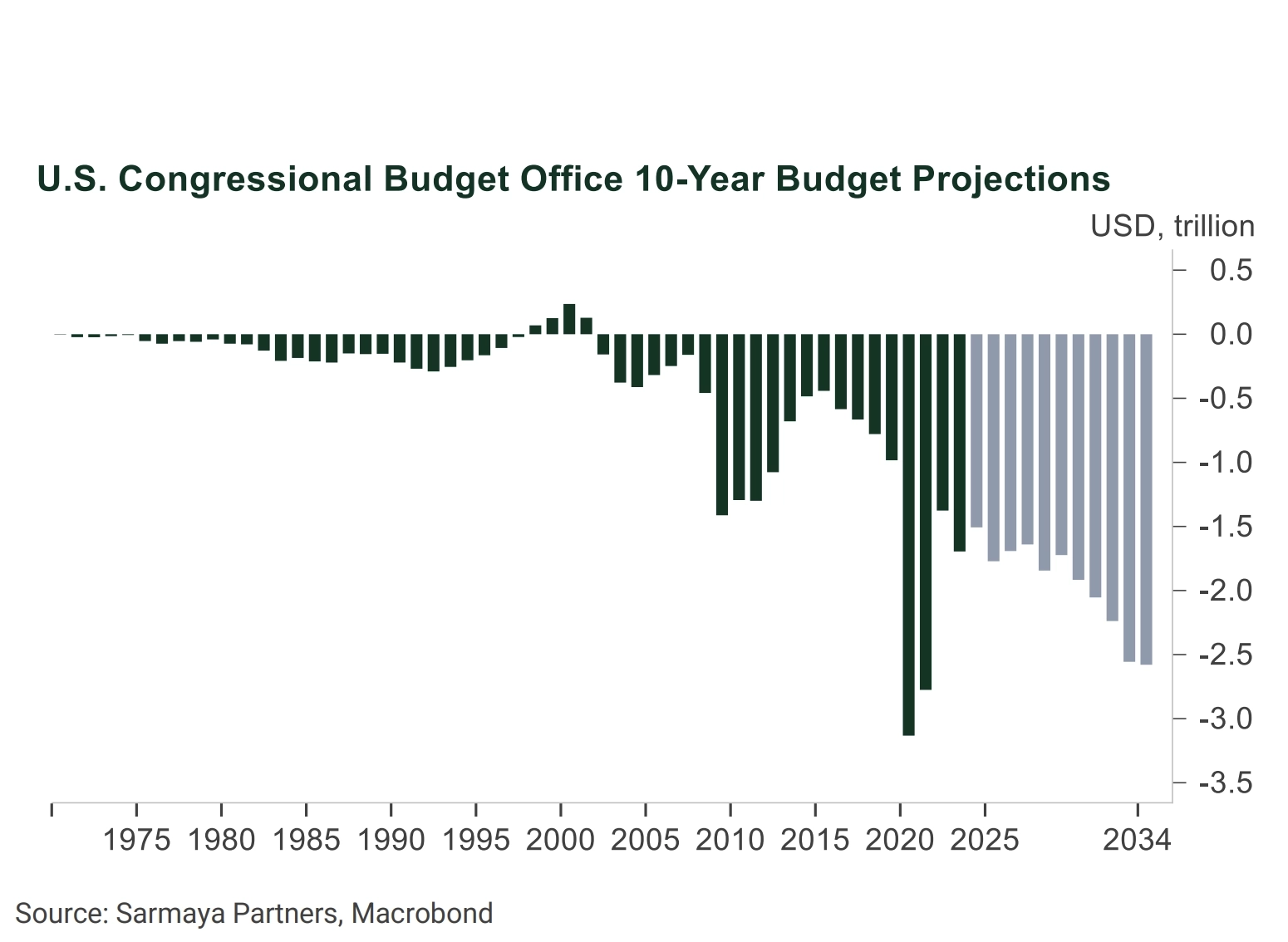

Policymakers have gotten a taste for fiscal spending, as evidenced by the ever-increasing levels of debt and deficits.

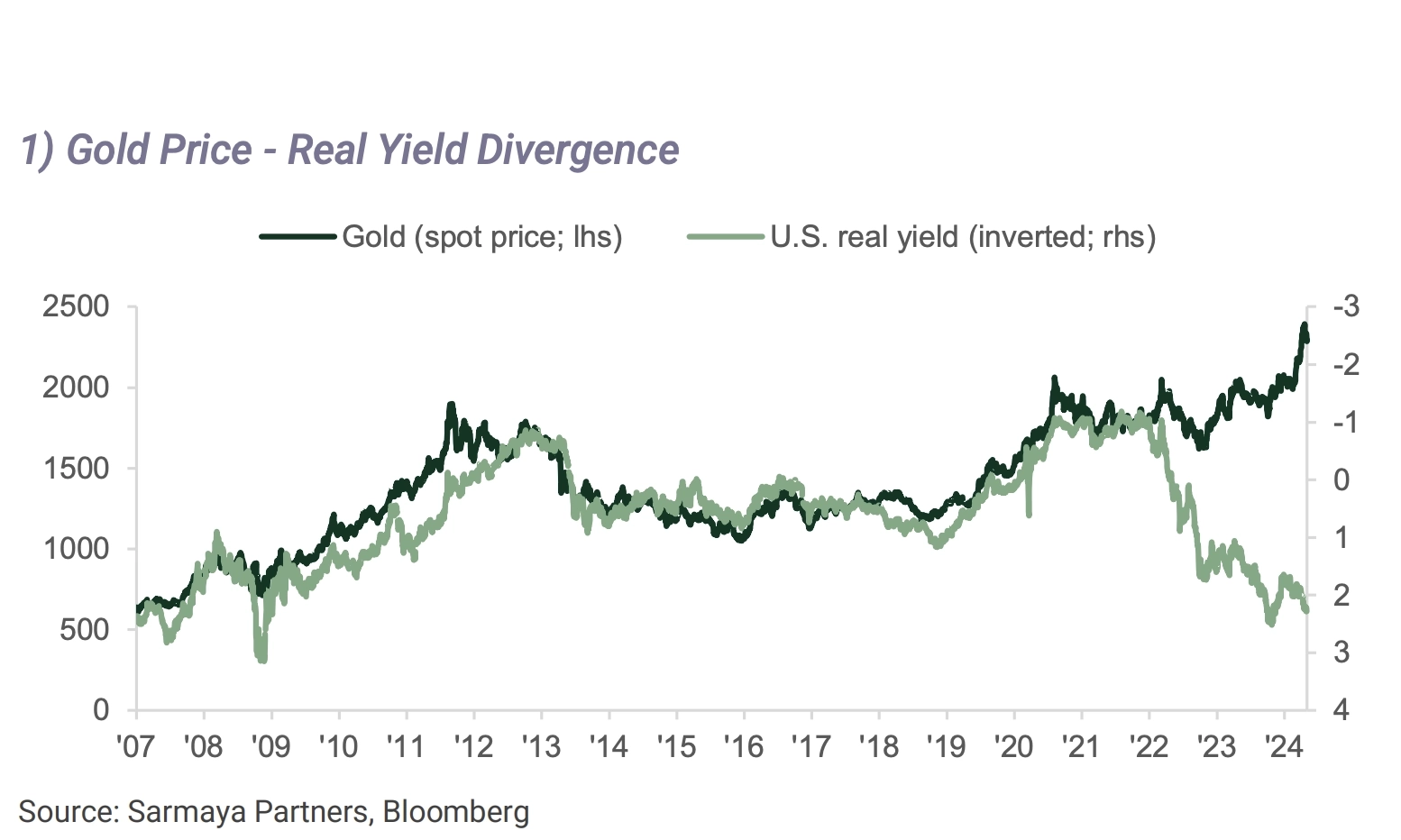

Navigating Geopolitical Risks with Gold

Despite inflation decreasing from its highs over the past two years, gold has managed to reach new record levels. There is a long-standing inverse relationship between gold and real interest rates, as real rates are a derivative of inflation applied onto rates. However, this correlation has broken down over the past two years with gold rising even as real rates have increased. This suggests the presence of buyers who are indifferent to inflation or real rate trends, likely non-U.S./Western buyers less affected by U.S. inflation or non-financial actors, driven by other factors.

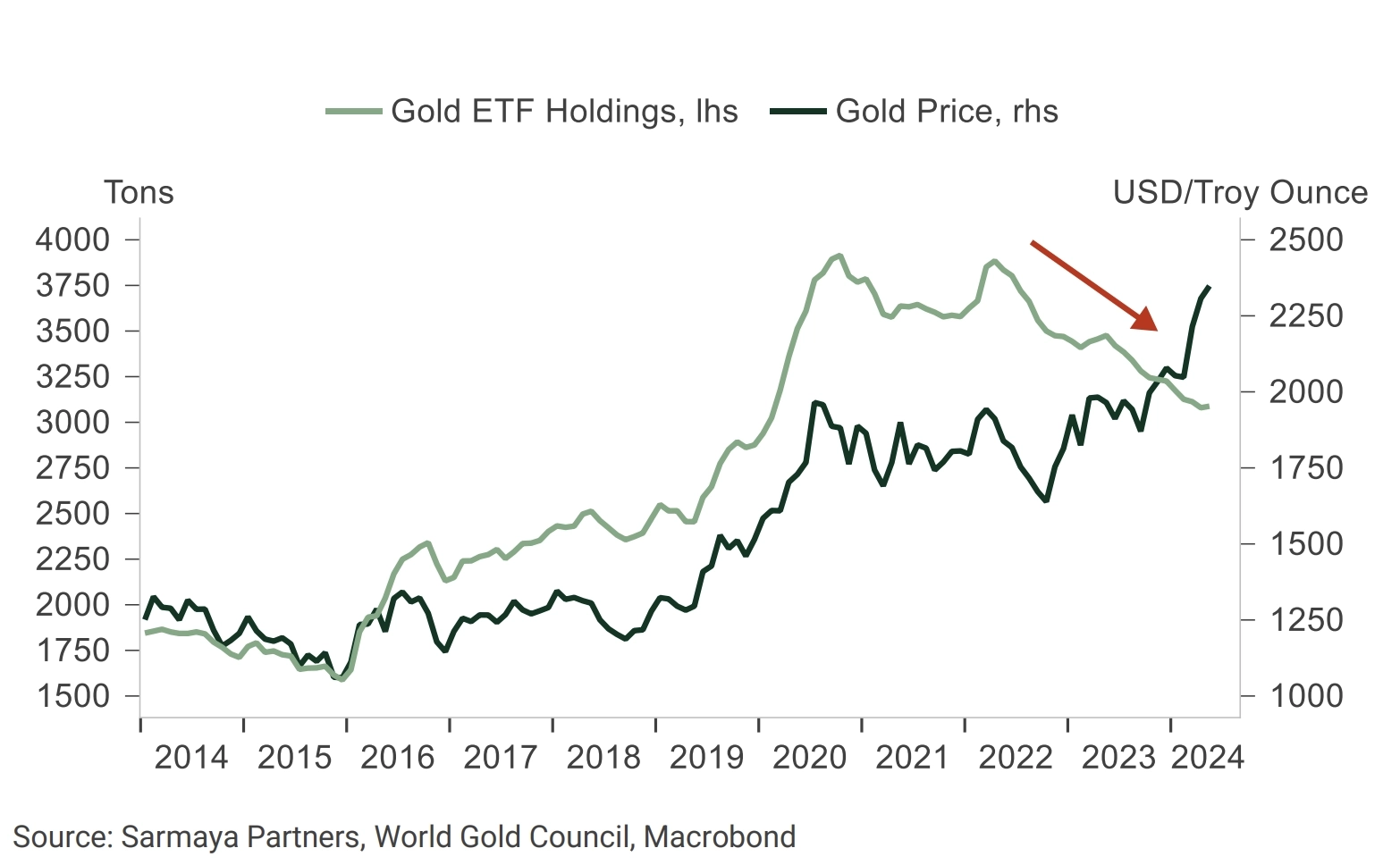

Signs of a Non-economic Buyer Like Central Banks:

ETFs’ Physical Gold Holdings Decreasing While Gold Price Appreciating

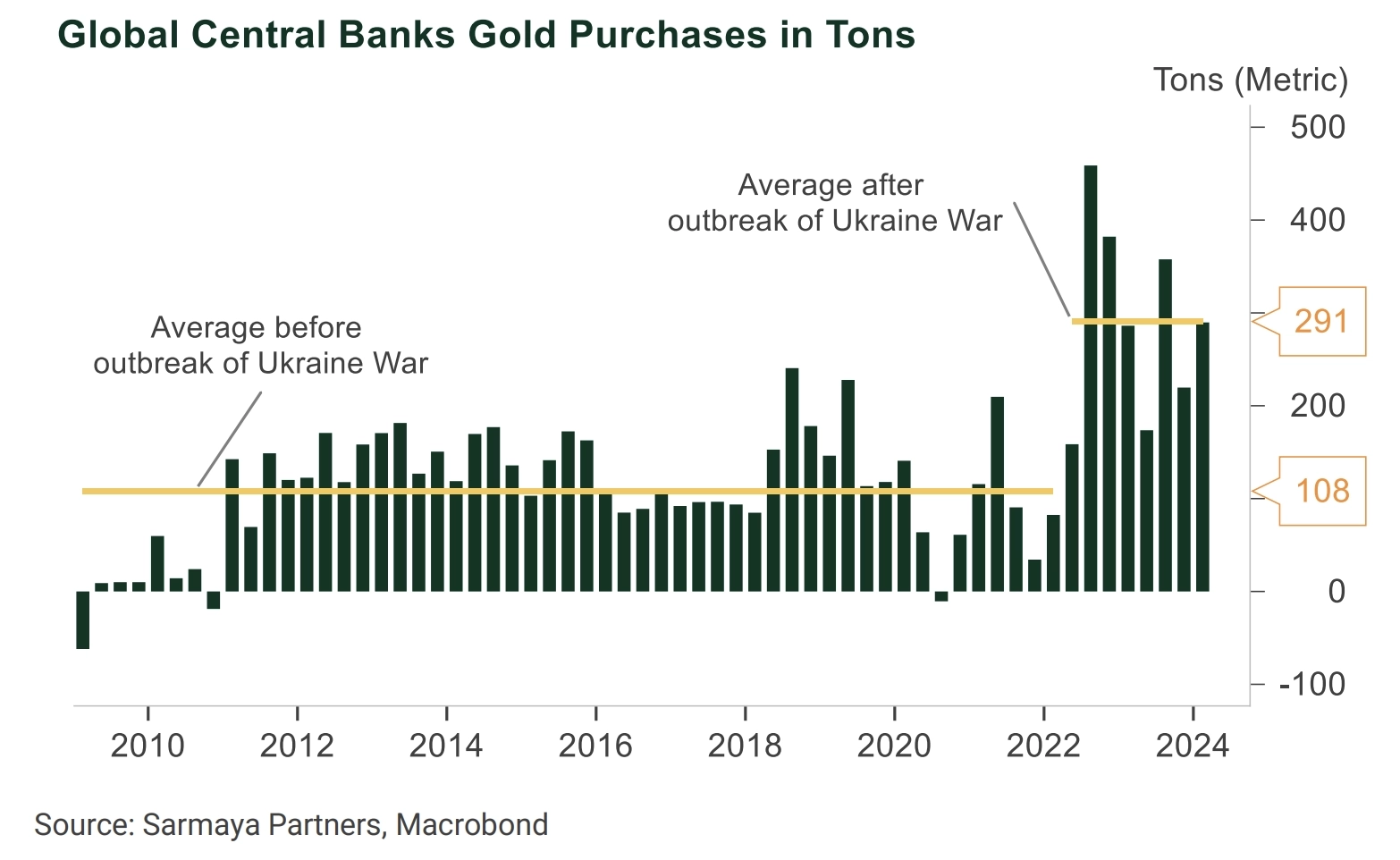

In addition to inflation, rising geopolitical risks have contributed in driving gold to record levels. Foreign investors and central banks are increasingly diversifying away from the U.S. dollar to hedge against geopolitical risk and overall fiat currency debasement.

Geopolitical risk has been rising since the Great Financial Crisis (GFC), driven by populism and increasing isolationism, leading to a multi-polar world. The first stage was the currency wars of the 2010s when major economies competitively devalued their currencies to boost exports and recover from post-crisis weakness. This was followed by trade wars later in the decade, now evolving into a cold war between the U.S. and China. The situation escalated further in 2022 with outright kinetic war in Eastern Europe thrown into the geopolitical cauldron.

The U.S.’ decision to weaponize the U.S. dollar in response to Russia’s invasion of Ukraine sent a global message: “your dollars are not yours.” Consequently, major central banks have become the marginal buyers of gold. And as non-economic actors, their purchasing is driven by strategic considerations, rather than price or the direction of inflation and interest rates. This shift helps explain gold’s recent decoupling from its historical relationship with real interest rates.

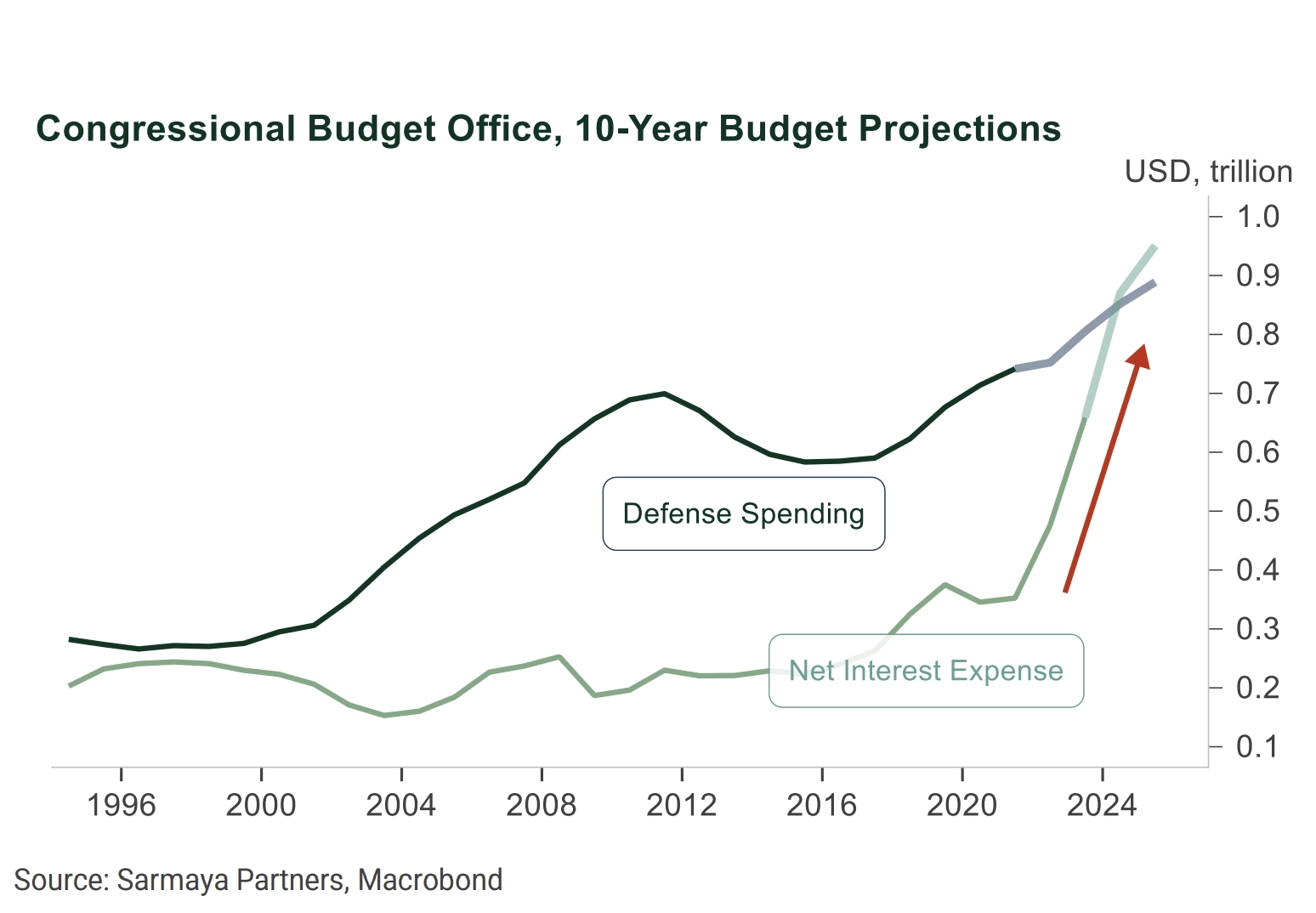

A haven in elevated sovereign Fiscal Risk

The developed world’s unabated deficit-driven spending, especially in the U.S. has turned sovereign debt from a slow-moving, non-factor issue for years into a rising concern for markets – accelerated by the rapid rise in interest rates. When money is free, you can borrow to the moon. But when the cost of borrowing rises, debt maintenance becomes a larger burden. Governments’ rising borrowing needs can crowd out the private sector, and in the face of rising rates, the debt service strains budgets.

U.S Debt Service > Defense Spending in 2024. Let that sink in…

There are a few ways to climb out of such a predicament: 1) Severe belt tightening through budget cuts and austerity measures, 2) default on the debt, or 3) inflate your way out of the debt. We don’t see the first two as likely outcomes given the populism in the current political atmosphere and the U.S.’ standing in the financial world. We see the third one as the likely outcome where even a low level of continuous inflation can chip away at that debt level, assuming it stops growing. They say the first step in getting out of a hole is to stop digging – so the fiscal spending needs to be curtailed as a precursor to managing this challenge. And part of the price of gold is reflecting the risks associated with the large deficits and looming debt servicing. Gold also doesn’t pose the counterparty risk that owning other financial instruments such as bonds or portfolio insurance derivatives would pose.

In Conclusion…

A cornerstone of The Return to Tangibles theme is humankind’s realization of our collective need and dependence on the tangible commodities that were taken for granted over the past decade.

The reawakened inflation, the search for an alternative store of value as a result of a weaponized U.S. dollar, and the Developed Markets’ debt growth nearing a potential accident are all contributing to gold once again being seen as a store of value and a haven. In our view, the new multi-year cycle bull market for gold has just begun.

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.