Return to Tangibles

The next commodity super-cycle has begun

© 2024 Sarmaya Partners, LLC

May 7, 2024

We Expect

- Commodities to dominate the market cycle, initiated around 2021-2022, driven by increasing global demand, persistent inflation, and a multi-polar geopolitical world.

- Energy-related sectors and commodities to gain market leadership after a decade of underperformance and also be recognized as the “picks & shovels” of the Artificial Intelligence (A.I.) and data land rush.

- Gold’s importance to increase as inflation remains in a persistently higher regime and as a haven amid elevated geopolitical and fiscal risks.

- U.S. re-industrialization and infrastructure investments as well as underappreciated growth in select emerging markets to boost demand for and outstrip supply of essential resources like oil, gas, copper, uranium, and minerals.

- Technology sector valuations, especially U.S. mega-cap tech stocks, to correct due to ebullient growth expectations – not unlike the dot-com bubble.

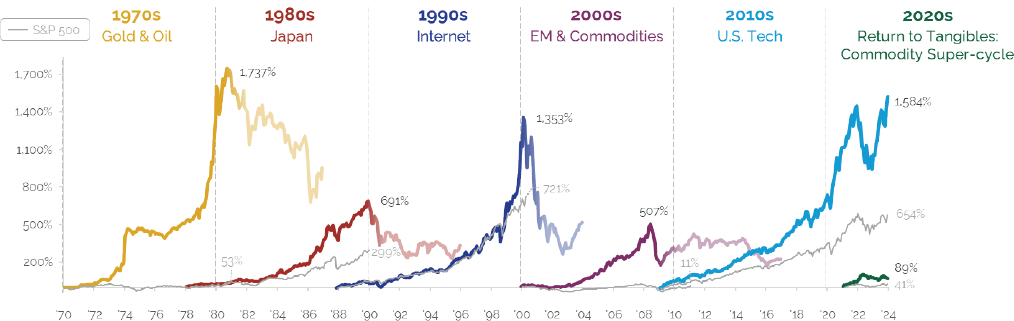

Themes Drive Markets Over Multi-year Cycles and Outpace Broader Benchmarks

Source: Sarmaya Partners; Bloomberg

Themes representation: Gold & Oil 1970s: 50% Gold/50% Oil (Spot Prices); Japan 1980s: Topix Index; Internet 1990s: Nasdaq Composite Index; EM & Commodities 2000s: 50% MSCI Emerging Markets Index/50% S&P GSCI Dynamic Total Return Index; US Tech 2010s: Nasdaq-100 Index, Commodity Cycle 2020s: S&P GSCI Dynamic Total Return Index

After years of underinvestment and self-defeating price wars among producers, the pandemic and the war in Eastern Europe acted as catalysts to remind the world that physical commodities are essential to life and economic progress, setting off the Return to Tangibles era. Supply discipline is now keeping prices range-bound while global demand is poised to continue growing.

We expect the Return to Tangibles theme to be a multi-year cycle and have evolving sub- themes that will continue to refresh and require an active approach. The sub themes will likely be driven by:

- Continuing global economic growth,

- Higher for longer inflation,

- Elevated geopolitical tensions driving the friendshoring and reindustrialization movement in the U.S., and

- The increased risk of a fiscal crisis or reckoning in the world’s major economies.

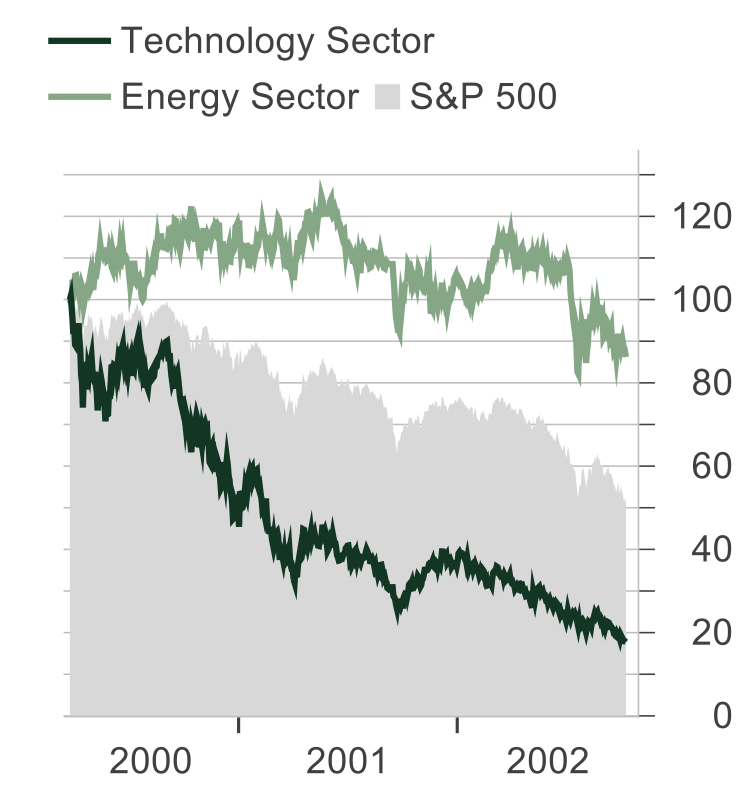

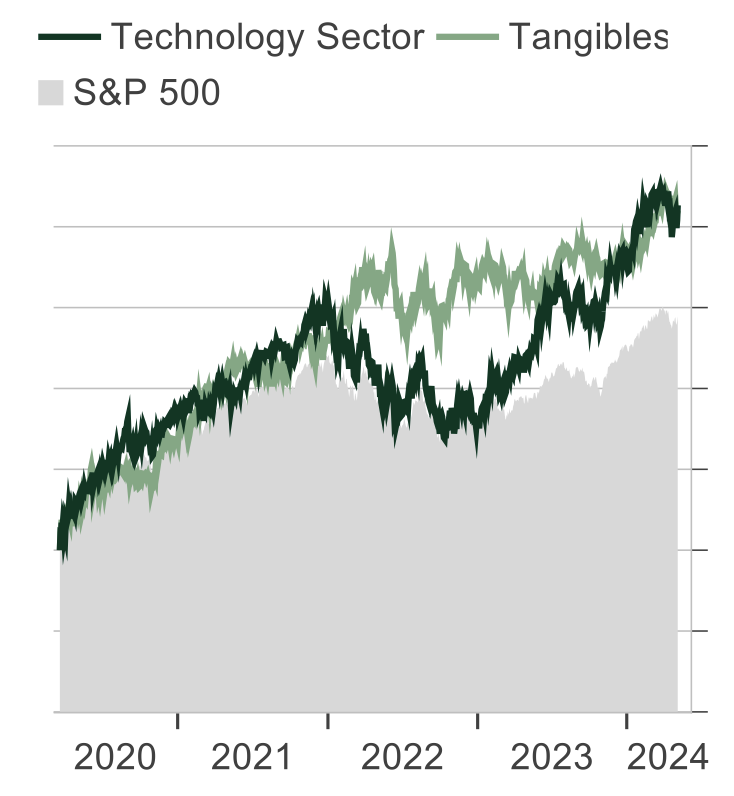

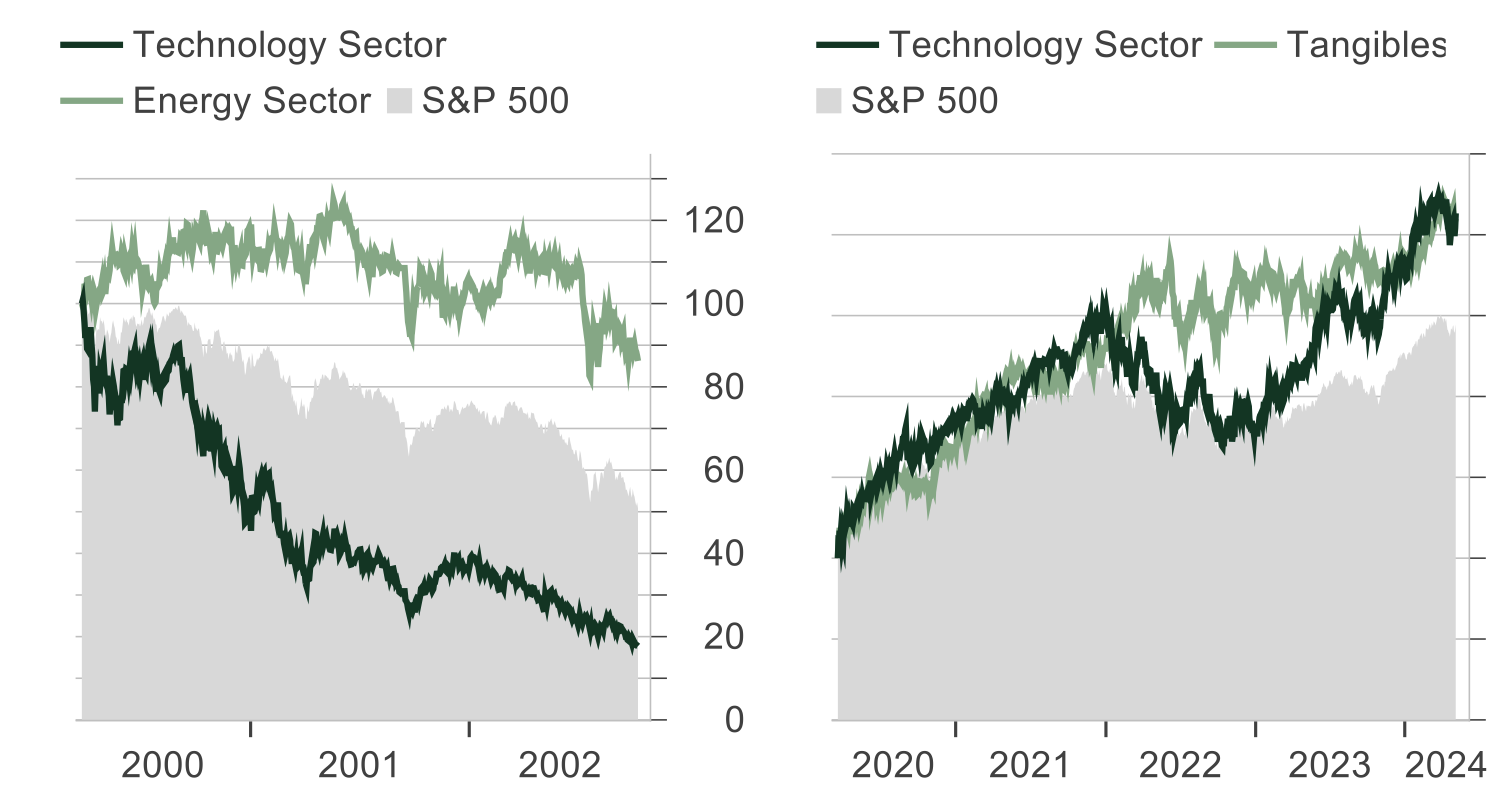

Additionally, we posit that the prevailing U.S. Mega cap tech theme is nearing its peak, before imploding under the weight of high valuations that reflect unrealistic investor exuberance in the face of slowing growth rates. This decline will also challenge the broader market given Big Tech’s ubiquity in global equity indexes. We expect the Tangible sectors like Energy to hold up better given their margin of safety through attractive valuations and looming structural growth – as it did in the 2000-2002 market.

We expect the ensuing market recovery to be led by the Return to Tangibles commodity assets, not Big Tech. History shows that each new market cycle is led by a different asset class or sector than the previous.

Expect Energy to Hold Up

Better in Market Decline…

and Tangibles Out

performance to Continue

Expect Energy to Hold Up

Better in Market Decline…

and Tangibles Out

performance to Continue

Source: Sarmaya Partners, Macrobond; rebased to 100 (left chart: dot-com bubble peak - trough; right chart: pandemic trough - 4/30/2024)

Everything is Awesome Market... Meet Normalized Rates

“And some things that should not have been forgotten were lost. History became legend. Legend became myth.”

– J.R.R. Tolkien

Post the Global Financial Crisis (GFC), central banks’ extremely low to zero interest rate policies and the implementation of Quantitative Easing (QE) helped stabilize financial markets and revive economies. However, the prolonged exposure of these unprecedented policies inadvertently distorted investment and financial market behaviors over the following decade. The cheap cost of capital encouraged increasingly riskier capital allocations into high-growth, and sometimes low to no-profit, investments. Thus, longer duration investments, such as long-maturity fixed income, real estate, venture, and technology flourished in this period.

For several years, investors and businesses benefitted from the cheap cost of capital and energy – until the pandemic helped reawaken inflation from its decades-long slumber. Like Sauron from The Lords of the Rings, inflation had been defeated previously, but not killed. And over the years, the memories of inflation became stories, which then turned to myth and it was eventually forgotten, until it returned.

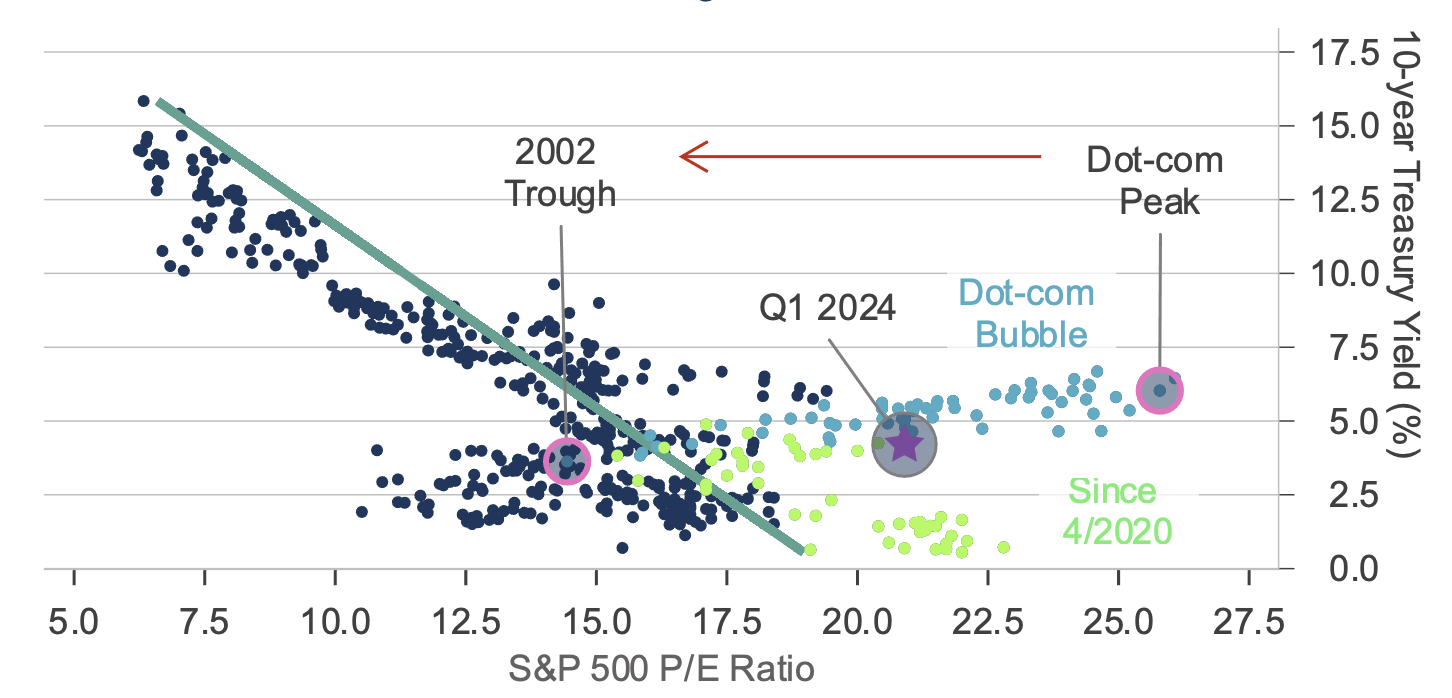

Inflation’s return pushed the world into a new era of higher interest rates. Borrowing costs have a foundational impact on most facets of the economy and financial markets. One strong correlation between interest rates is with stock PE ratios (Price/Earnings) as shown in the chart below. While it can be a slow-moving process as the change in interest rates work with a lag, it is a statistically reliable relationship – over time, higher rates beget lower stock price multiples and vice versa.

Interest Rate Normalization to Weigh on Valuations

Source: Sarmaya Partners, Macrobond

Shift to Tangibles

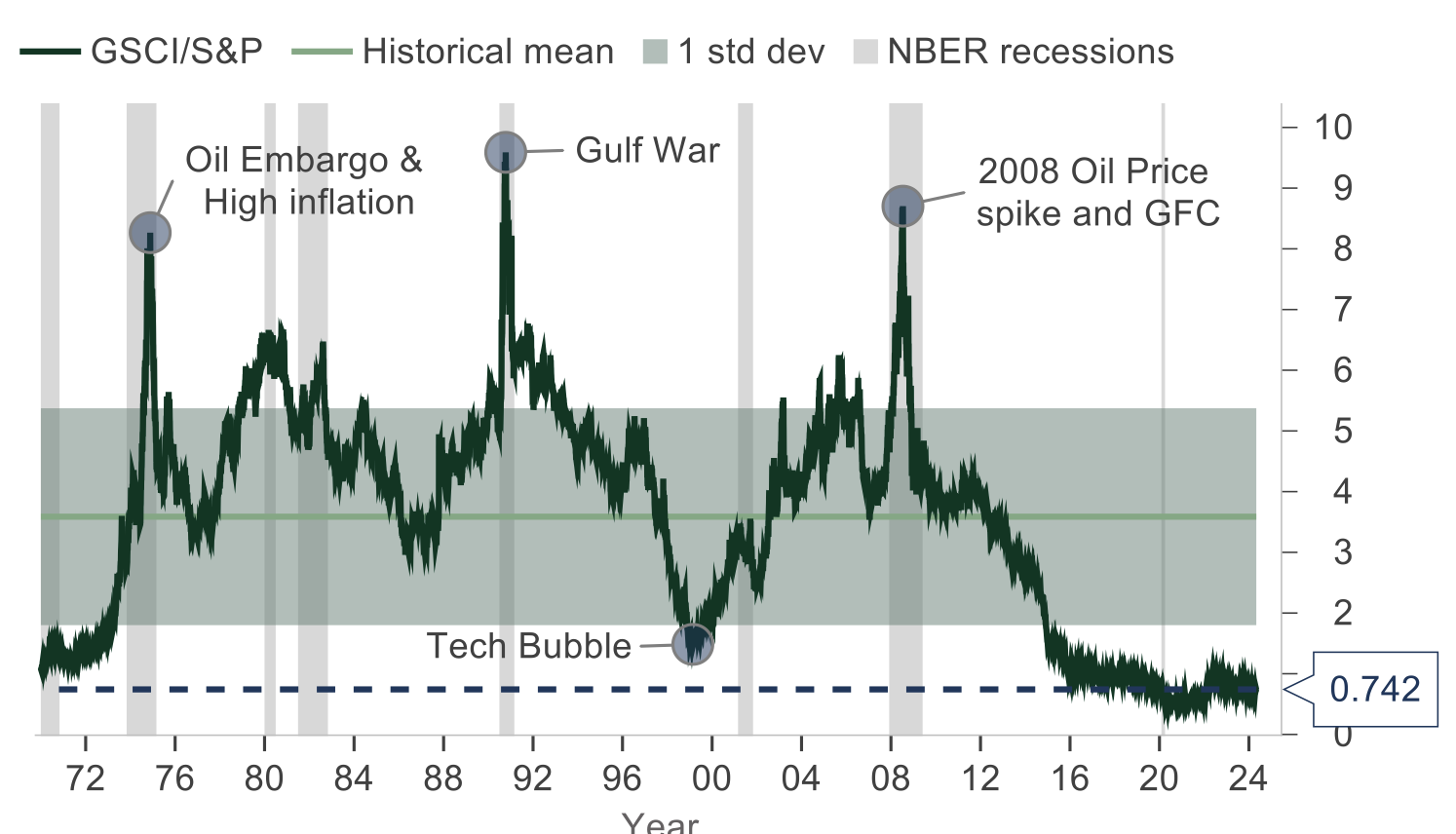

In our view, markets crossed the Rubicon in 2021-2022, marking the beginning of the next regime which will be led by investments in the commodity complex.

The market belief of a post-commodity world where our virtual and detached existence wouldn’t need dirty physical materials was rudely awakened by the supply-, inflation- and geopolitical shocks of 2021-2022. These shocks were the catalysts of the Return to Tangibles theme, which we believe will dominate in the next multi-year market cycle.

The Return to Tangibles theme is rooted in years of underinvestment, driven by low commodity prices, poor capital allocation and supply discipline by producers in the prior cycle. The sustainability movement exacerbated the situation by constraining capital investment by prioritizing alternative energy and growth technology investments, supported by the post-GFC low interest rate environment.

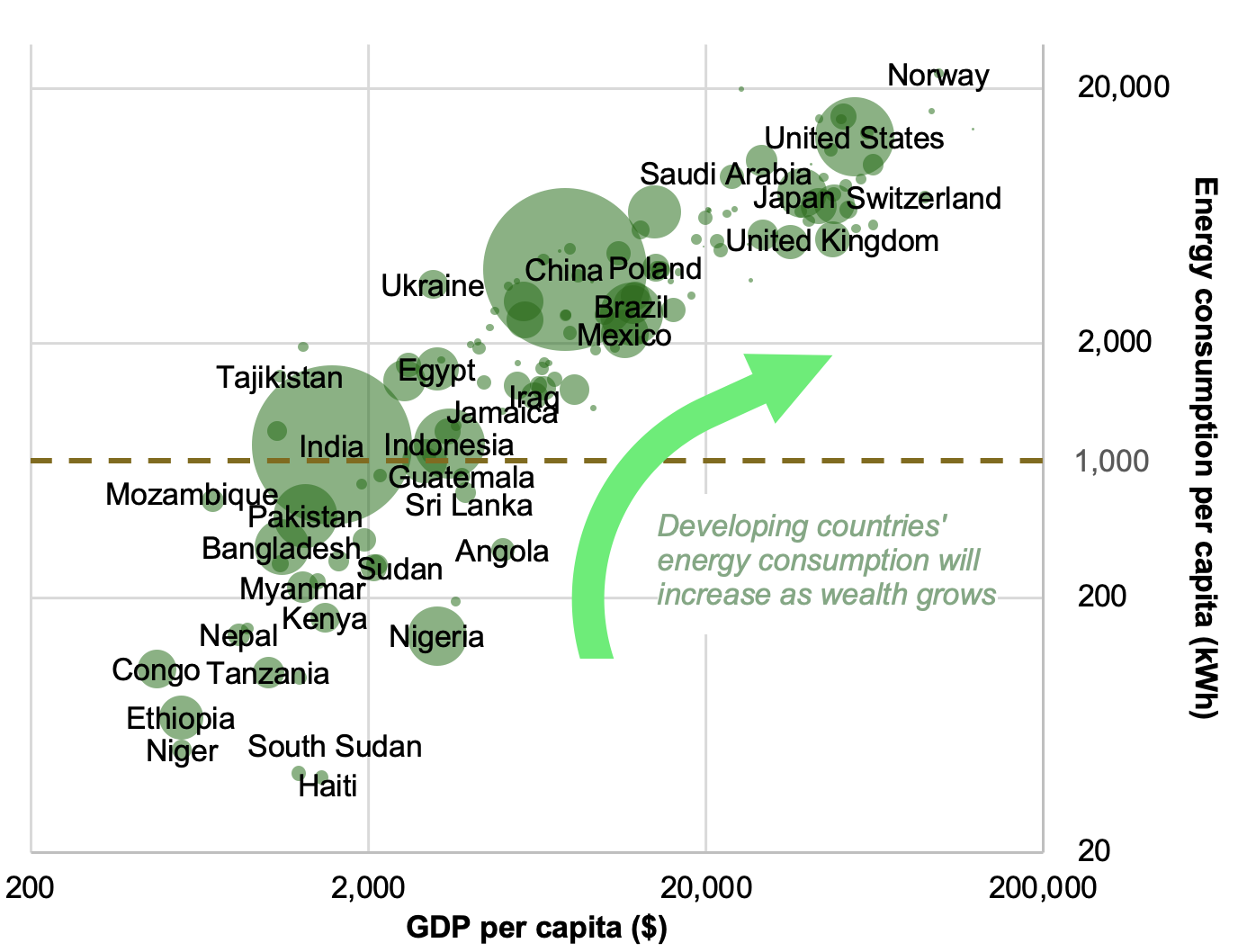

Despite the post-pandemic anemic global economy, demand has remained persistent. Energy demand is expected to increase from the growing emerging world, led by places like India, the A.I. datacenter buildouts, and the U.S. reindustrialization renaissance. This increasing energy demand should initially benefit oil and gas, and uranium – as nuclear power regains popularity. Metals will benefit, especially copper as it feeds infrastructure needs. And gold will be in demand in the face of geopolitical and fiscal risks.

Commodities at Historical Bottom Relative to S&P 500

Source: Macrobond; NBER (National Bureau of Economic Research), S&P Global

Inflation

“A wizard is never late, Frodo Baggins. Nor is he early. He arrives precisely when he means to.”

– Gandalf, from Lord of the Rings

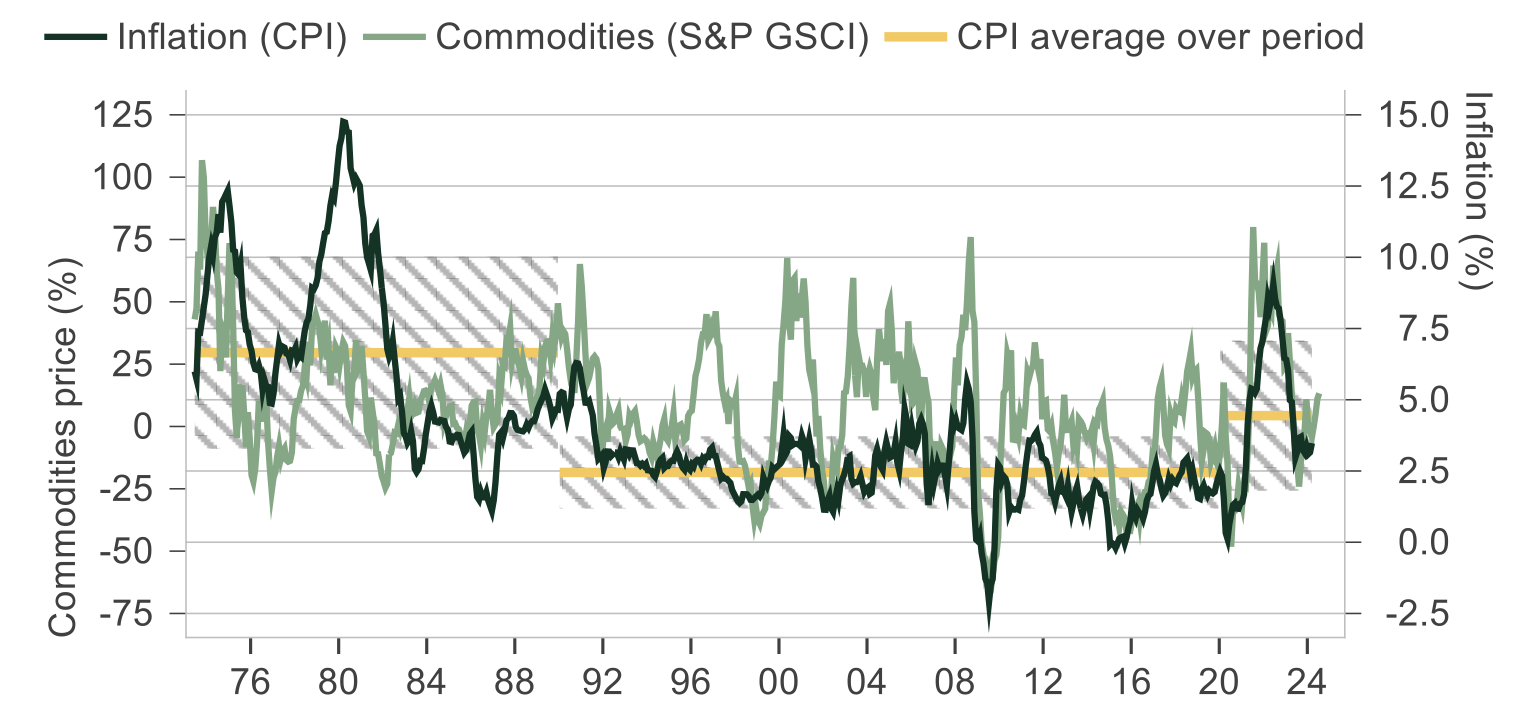

When the Fed embarked on the QE journey in 2009-2010, the market expected inflation to flare up. However, it was anemic as the monetary stimulus remained in the financial system. Inflation’s catalyst arrived during the pandemic when both fiscal and monetary channels were deployed at war-time levels. The resulting demand for goods by consumers, flush with stimulus money and market gains, met global supply chain bottlenecks – stoking the first embers of inflation.

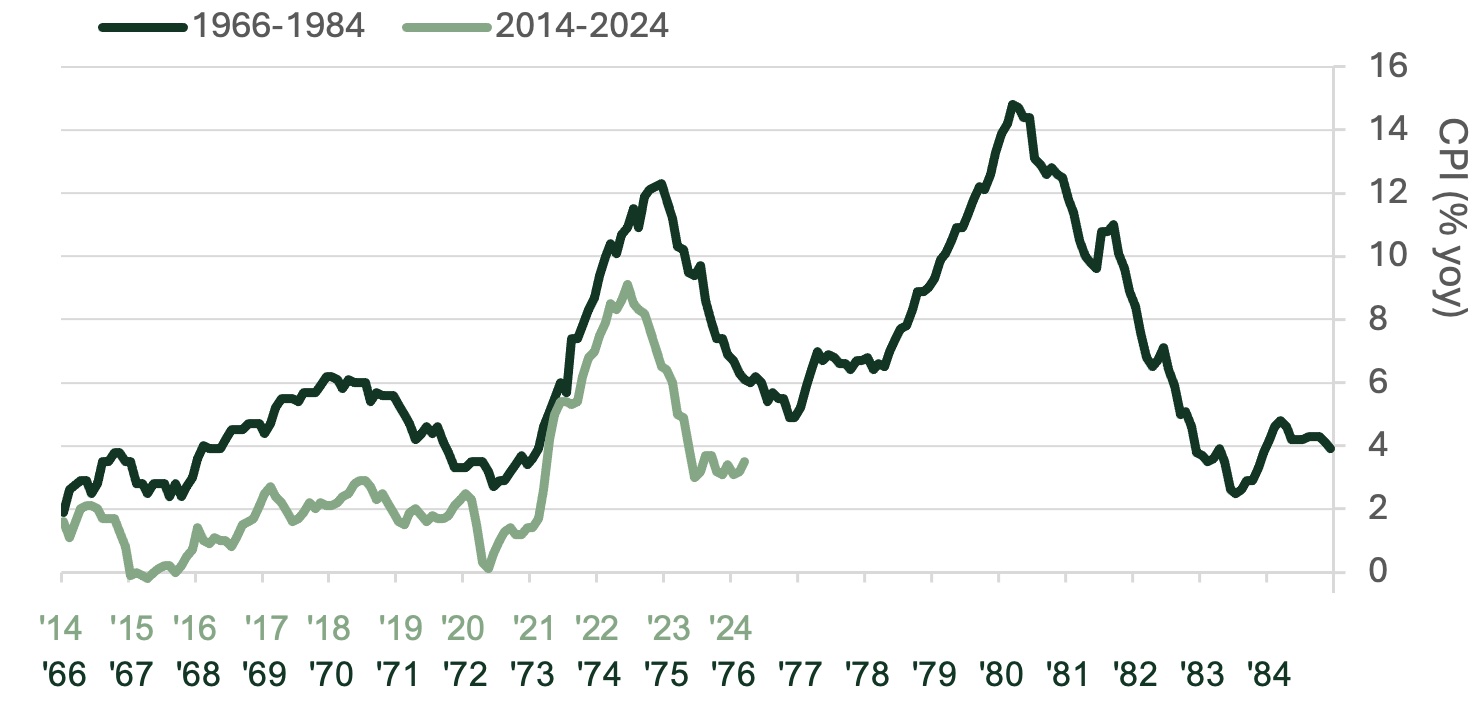

Since then, it has remained stubbornly persistent in the economy, moving from goods to housing and services. We expect inflation to remain in a higher, longer-term range than during the pre-pandemic decade.

Strong Relationship Between CPI & Commodities Intact

Source: Sarmaya Partners, Macrobond

Current Inflation Pattern Reminiscent of the 1970s

Source: Apollo, Bloomberg; through 3/31/2024

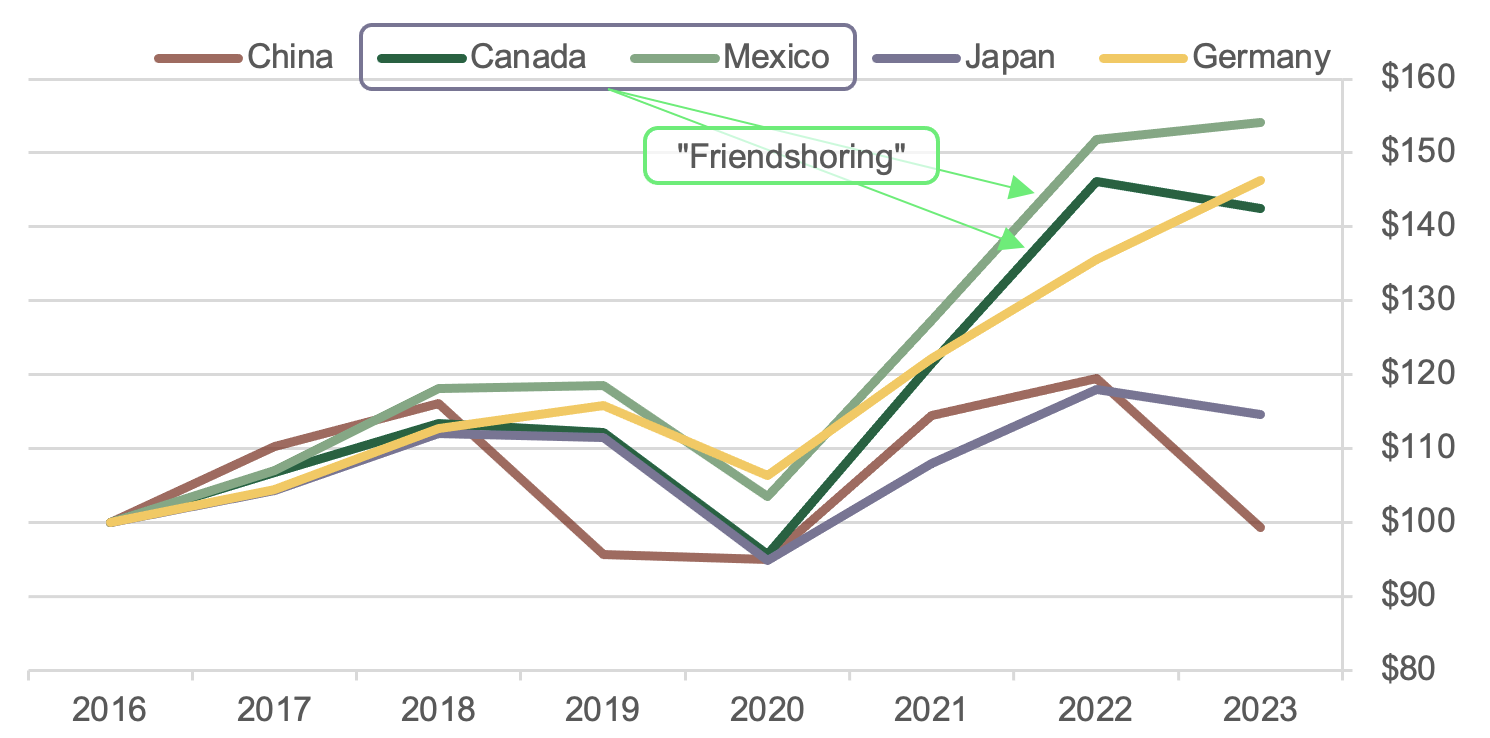

The pandemic also brought simmering structural imbalances, geopolitical issues, and the global economy’s fragility into plain view. Surging goods prices revealed a complex, interdependent, and fragile global supply chain network, which also highlighted the importance of some natural resource suppliers. Add to this populism, protectionism, and geopolitics, and the resulting onshoring/friendshoring becoming another inflationary force. Sticky wages, driven by decreased supply in the U.S. and labor unions in Europe also have kept upward pressure on inflation.

Fed No Longer “The Only Game In Town”

While the Fed was focused on fighting the “last war” against deflation, and its “team transitory” saw inflation in 2021 as temporary, the fiscal side of the ledger played a significant part in stoking inflation. Fiscal stimulus, deployed at wartime levels since 2020, continues to support the U.S. economy. And policymakers have gotten a taste of fiscal spending, as highlighted by the ever-increasing levels of debt and deficits.

So even though the Fed, after finally jumping into the inflation fight in the summer of 2022, has maintained the discipline of keeping rates higher for longer, inflation remains persistent as fiscal policy continues to provide ample liquidity. This has been the major paradigm shift – the market and economy moving from monetary dominance to fiscal dominance. In other words, the Fed is draining the punchbowl to fight inflation and the government is refilling it, feeding inflation.

Return to Tangibles Sub-Themes

Energy is Life

The last oil boom that ended in 2014, set off six painful years for energy producers that culminated in the oil price going negative in the depths of the pandemic panic in March 2020.

These struggles, coupled with the rising impact of environmental (E of ESG) goals towards sustainability and a transition to alternative energy sources pushed the traditional energy sector into a perfect storm. Their revenue had declined, and the market wasn’t interested in funding them.

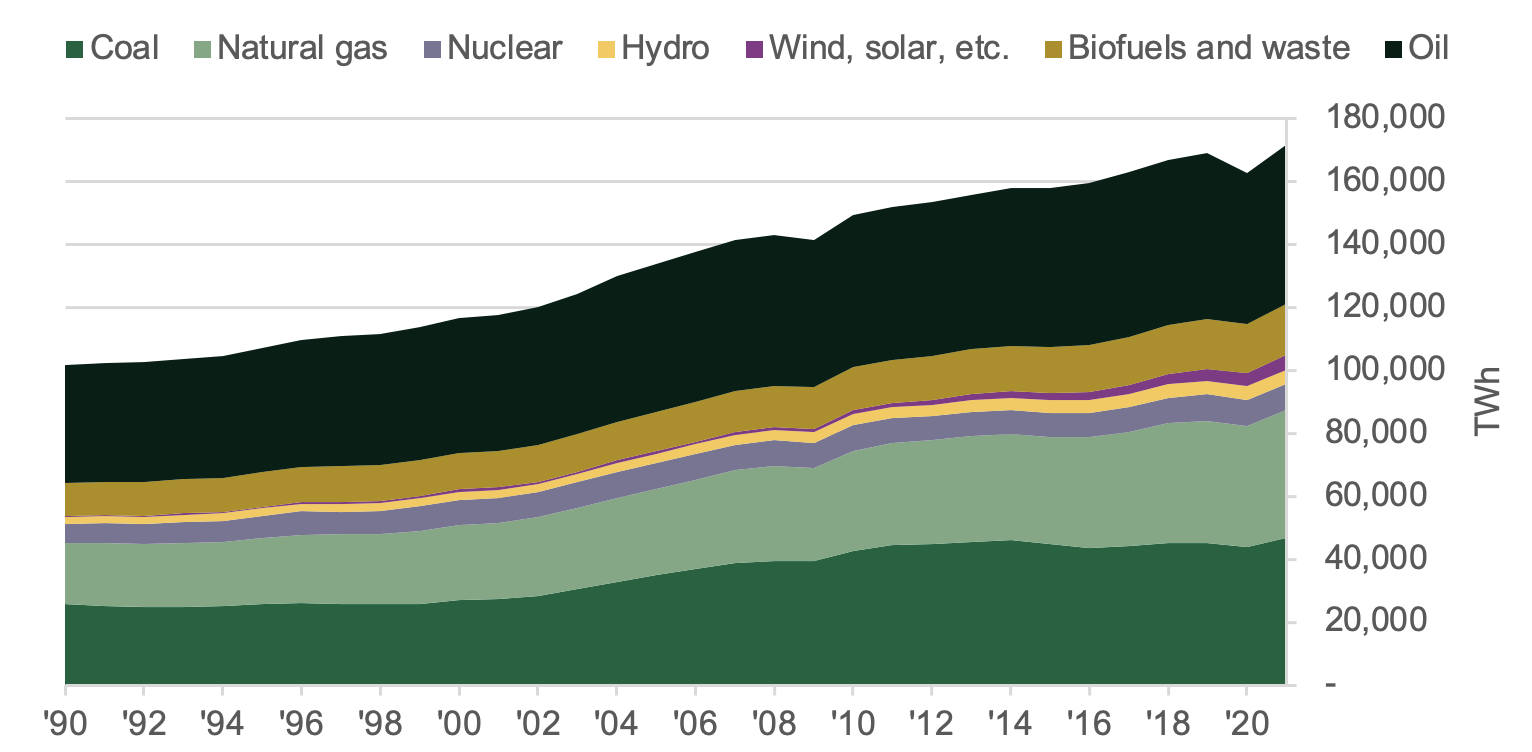

Global Energy Consumption & Sources

Source: Sarmaya Partners, Our World In Data

Fossil fuels were presumed to be on their deathbed, however, the inflation and rate shocks showed otherwise.

Since going negative in the pandemic lows, oil prices have recovered strongly, reflecting stable and steadily growing global demand. Combined with Russia’s supply curtailment and the Saudi-led supply discipline from OPEC+, the oil market is healthy with attractive investment fundamentals. Additionally, M&A activity has jumped in the sector.

WTI Oil Price – USD

Source: Sarmaya Partners, Bloomberg

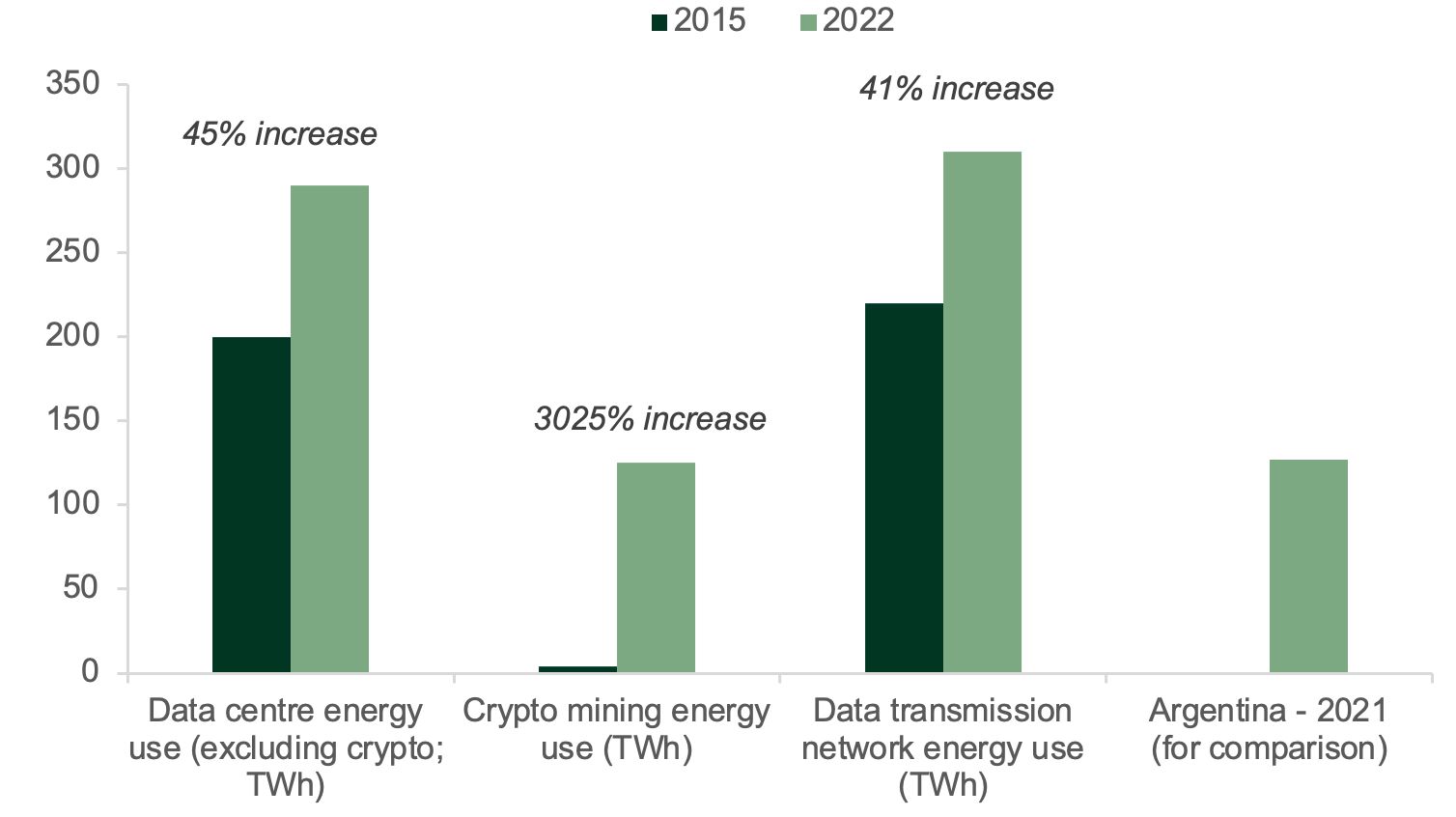

Other factors contributing to the demand outlook for energy are the A.I. technology revolution’s reliance on abundant energy, the crypto mining industry’s high energy needs, and the vulnerabilities of the aging U.S. electric grid systems reliance on alternative energy sources, that have struggled to meet urgent surge capacity and reliable storage.

Additionally, the search for non-fossil fuel solutions to these challenges has brought nuclear power generation back to the fore. Utility companies and governments globally have been dusting off nuclear power generation plans and starting new projects. Nuclear power generation advancements, such as building smaller modular reactors, make these projects less daunting. The growth of these new projects requires ample uranium, which has seen its price surge.

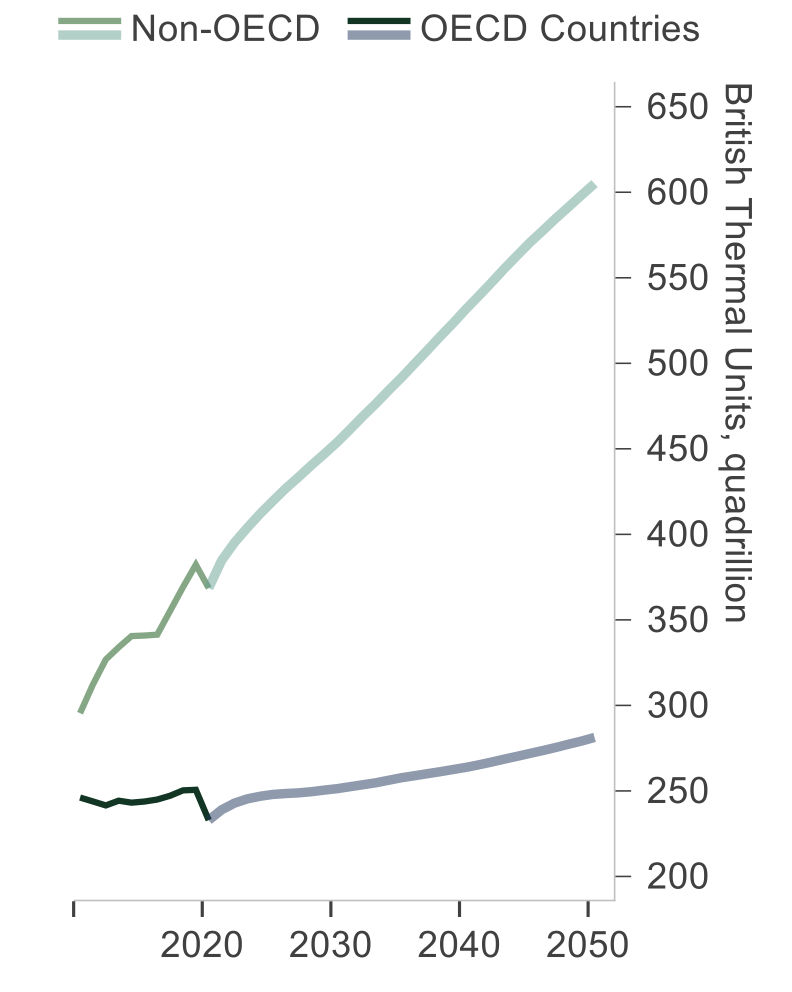

Developing Countries’ Energy

Use to Grow Significantly

No Such Thing as a Low-Energy

Rich Country

Source: Sarmaya Partners, Macrobond, EIA Energy Consumption Estimate, World Bank

Build the Future:

A.I. Technology and Emerging Country Growth

Many are calling the breakthrough in A.I. (Artificial Intelligence) as significant as the advent of the printing press, the steam engine, human flight, the transistor, the Internet and the smart phone (to name a few) – thereby becoming the catalyst to usher in the next Industrial Revolution.

Such world-changing innovations have also required large capital investment in the infrastructure to power or produce the new technology for large scale deployment. For A.I., that infrastructure looks like enormous data centers that will require large quantities of copper for their build out and eye watering levels of energy to power them.

Big Tech is competing in a “land rush” for all resources to plant the dominance flag in A.I. History shows that not ALL can be winners in this “land rush”. It also shows us that they will all need the leading “picks and shovels” of this rush in the shape of copper, oil, gas and uranium.

Tech and Crypto Energy Use is Underappreciated

Source: Sarmaya Partners, IEA

Additionally, A.I. alongside its foundational semiconductor chips have become strategic national assets. There is now an arms race for control and supremacy in semiconductors in the new multi-polar era. Thus, A.I. infrastructure will be built out multifold across the world. While we disagree that data is the “new oil” and that “oil is still the new oil”, chips and data will increasingly be essential national assets worth fighting over. Government spending on these technologies through bills such as the CHIPs and IRA acts in the U.S. is likely to continue.

Emerging nations’ growth and development goals will also drive copper, energy, and broad commodity demand. India is one of the fastest growing large economies, where the government aims to be the world’s third largest economy in three years and reach a $7 trillion size by 2030. A cornerstone of this growth is expected to come from $1.72 trillion in infrastructure investments between 2024 and 2030, with both domestic spending and foreign direct investment.

Not to count it out, China’s infrastructure spending in its sphere of influence and securing resources will be at large scale once it emerges from its pandemic-driven growth slowdown.

Geopolitical and Fiscal Risk

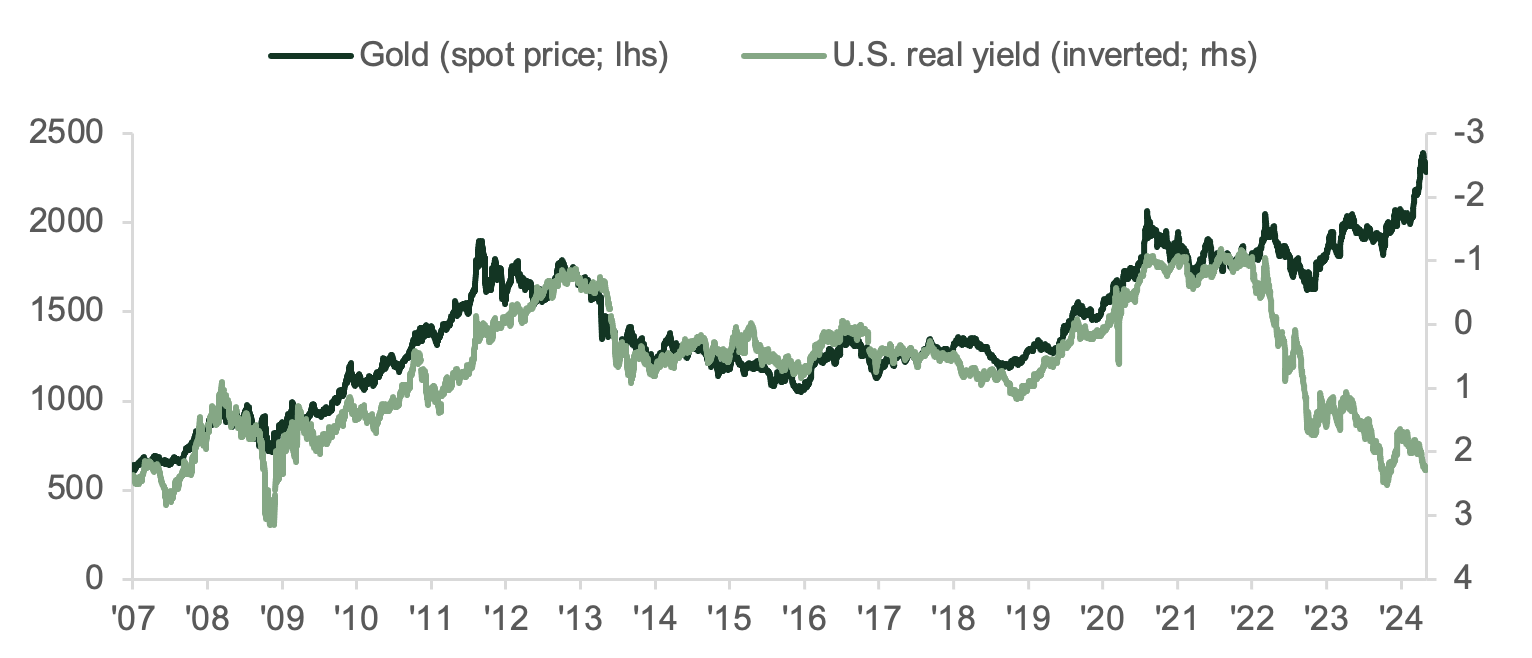

In addition to inflation, rising geopolitical risks have driven the price of gold to record levels. Investors and central banks look to diversify their assets away from the U.S. dollar and have a hedge against overall fiat debasement.

Geopolitical risk has been rising since the GFC, driven by populism and increasing isolationism, leading to a multi-polar world. These risks are now becoming increasingly impactful to the market.

The first stage was the currency wars of the 2010s when major economies competitively devalued their currencies to increase exports and grow their way out of the post-crisis weakness. Then came the trade wars later in the decade, which are now morphing into a cold war between the U.S. and China. Furthermore, in 2022 the world threw outright kinetic war into the geopolitical cauldron.

Additionally, the developed world’s unabated deficit driven spending, especially in the U.S. has turned sovereign debt from a slow-moving, non-factor issue for years into a rising concern for markets – accelerated by the rapid rise in interest rates. When money is free, you can borrow to the moon. But when the cost of borrowing rises, debt maintenance alone can be a burden.

Furthermore, the U.S.’ decision to weaponize the U.S. dollar in response to Russia’s invasion of Ukraine sent a message across the world to friend and foe alike – “your dollars are not yours.” Since then, major central banks have been the marginal buyers of gold. And as non-economic actors, their purchasing has been continuous irrespective of price or the direction of inflation and interest rates. This can help explain gold’s decoupling from its historical relationship in real interest rates.

Gold Price – Real Yield Divergence:

Sign of a non-economic buyer like central banks

Source: Sarmaya Partners, Bloomberg

Finally, the economic rise of Asia led this decade by India will push consumer demand for gold to new highs, given the cultural and economic importance gold had in those cultures and consumers. The center of gold demand, trading and wealth is moving from the western developed world to the eastern emerging world.

Onshoring & Reindustrializing America:

The pandemic’s shortages and ensuing price spikes revealed the fragility of the global supply chain systems. The interconnected dependencies for goods led businesses to question the decades-long practice of just-in-time inventory and start thinking about just-in-case inventory surpluses. And they also looked to diversify sourcing from other geographies.

The U.S., saw the risk of China’s importance as the leading or sole supplier for many goods, further escalating the trade war and nascent Cold War with China, pushing the onshoring and friendshoring movement further.

Friendshoring Reconfiguration Has Begun

Source: Sarmaya Partners, Bloomberg; rebased to 100 in 2016

The importance of self-reliance in an increasingly multi-polar and less friendly world has also reawakened the movement to Reindustrialize America. And energy self-reliance is at the core of this process. The infrastructure and semiconductor build-out policies are a good beginning – but more needs to be done for greater self or friend reliance.

While these steps may be necessary ingredients in making an anti-fragile supply chain system and for greater national security, building all this infrastructure and redundancies will require significant financial, human, and natural resources – and will be inflationary.

Market Shift from Technology to Tangibles

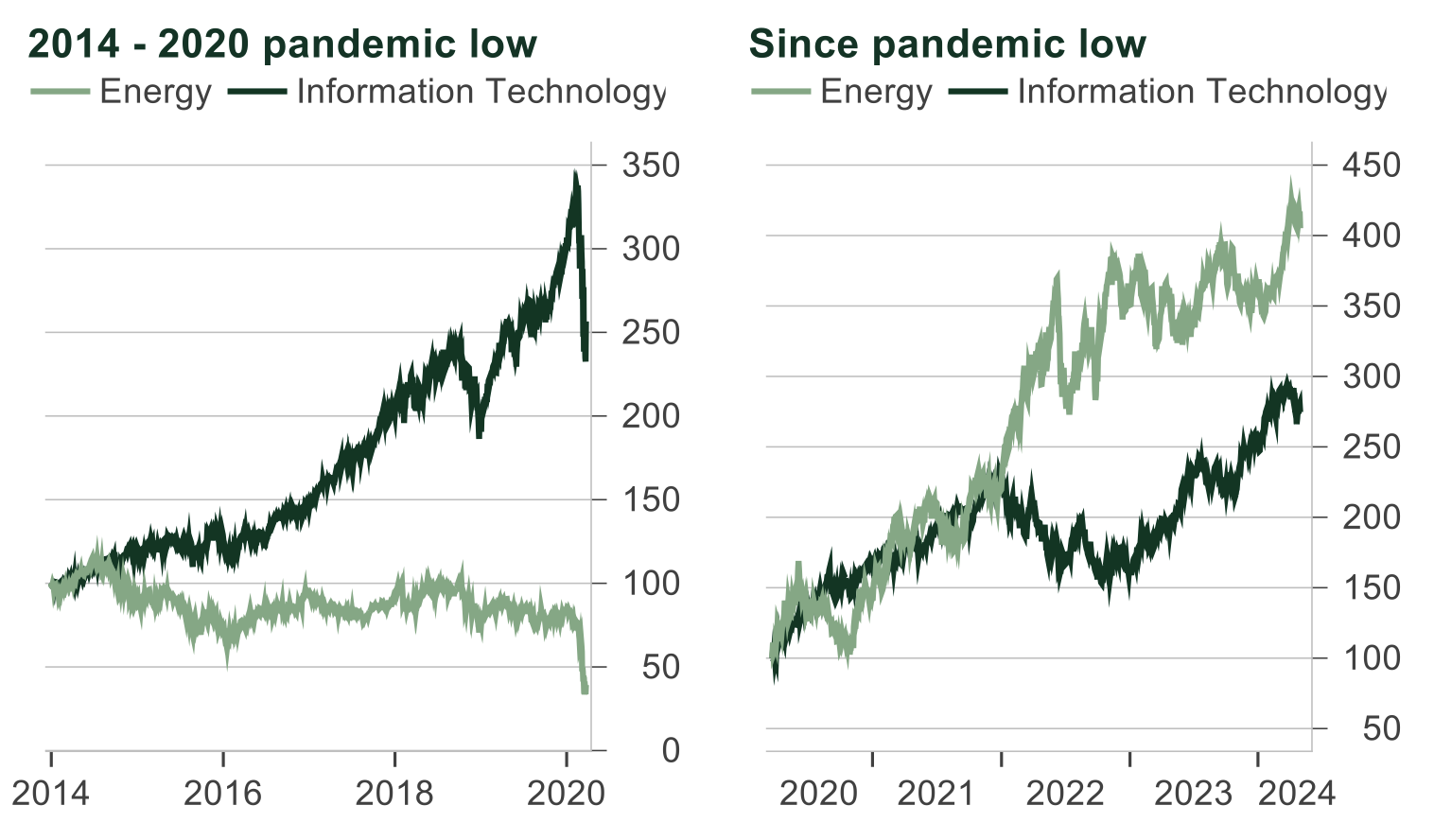

Energy’s underperformance vs Tech’s outperformance during 2014-2020 has been nothing less than remarkable – we expect the reversal of that will be equally remarkable, not unlike the 2000s.

Energy vs Tech Reversal Just The Beginning

Source: Sarmaya Partners, Macrobond

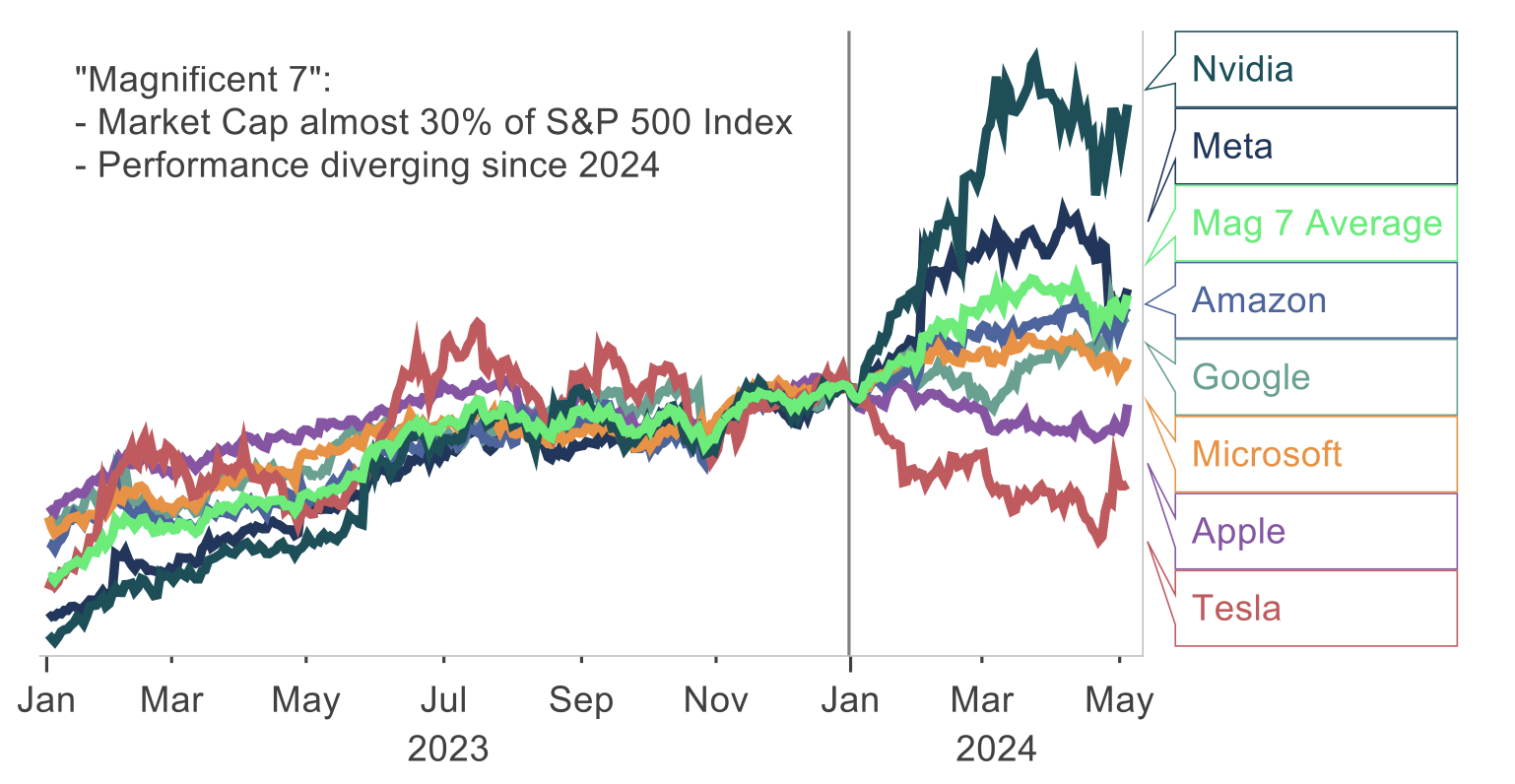

We posit that the prevailing U.S. Mega cap tech theme is nearing its peak. The market has become narrative and momentum-driven, and risks imploding under the weight of U.S. mega cap stocks’ valuations reflecting unrealistic investor exuberance in the face of slowing earnings growth. We believe it might resemble something like the tech bear market of the early 2000s.

Mag 7 –> Super 6 –> Fab 5 –> Fantastic 4 …–> Lone Ranger?

Source: Sarmaya Partners, Macrobond; Mag 7 Average = market-cap-weighted

To be clear, we are not skeptics of A.I.’s potential. This technology will indeed change the world and boost productivity. We are, however, wary of the rich stock valuations and exuberant narratives of its posterchild companies. In prior technological breakthroughs, such share price exuberance did not end well – examples are, railroads, radio, the automobile, television, the personal computer and the internet. Instead, we prefer to play the A.I. boom through energy, copper, and uranium as the growth of this technology is expected to require massive amounts of energy and materials.

While inflation has receded, it has not been vanquished. And that implies higher interest rates for longer. The long lags of higher rates will eventually begin to bite price multiples – as there is a strong inverse relationship between valuations and interest rates (see chart early in the note). Thus, the rich valuations of the U.S. tech and similar growth stocks remain vulnerable to the normalized interest rate era. The U.S. Tech theme might retain its momentum for the remainder of 2024; however, we are closer to its end than to its renewal.

In Conclusion

Over the past decade humankind’s movement towards Intangibles has been profound. Our increasingly digital activities, the physical detachments of social media, the diminished attention spans, to even the significant increase in intangible assets vs tangible assets in financial statements, all represent the era where markets and the societal zeitgeist took the material world for granted.

The world forgot that every physical thing we consume and use originated from the ground, before industrial and agricultural processes transformed it into items for consumption.

The pandemic and the war in Eastern Europe reminded the world that it cannot survive, let alone grow, without the tangibles.

The Return to Tangibles has begun.

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.