The 1960s Nifty Fifty bull market ended when the companies once thought of as bulletproof turned out to be sensitive to the economic cycle and excessive valuations weighed too heavily. Loose monetary policy and deficit-led fiscal spending in the 1960s gave rise to the inflationary 1970s, with gold’s value almost tripling by 1973 when oil supply shocks hit, sending oil prices soaring.

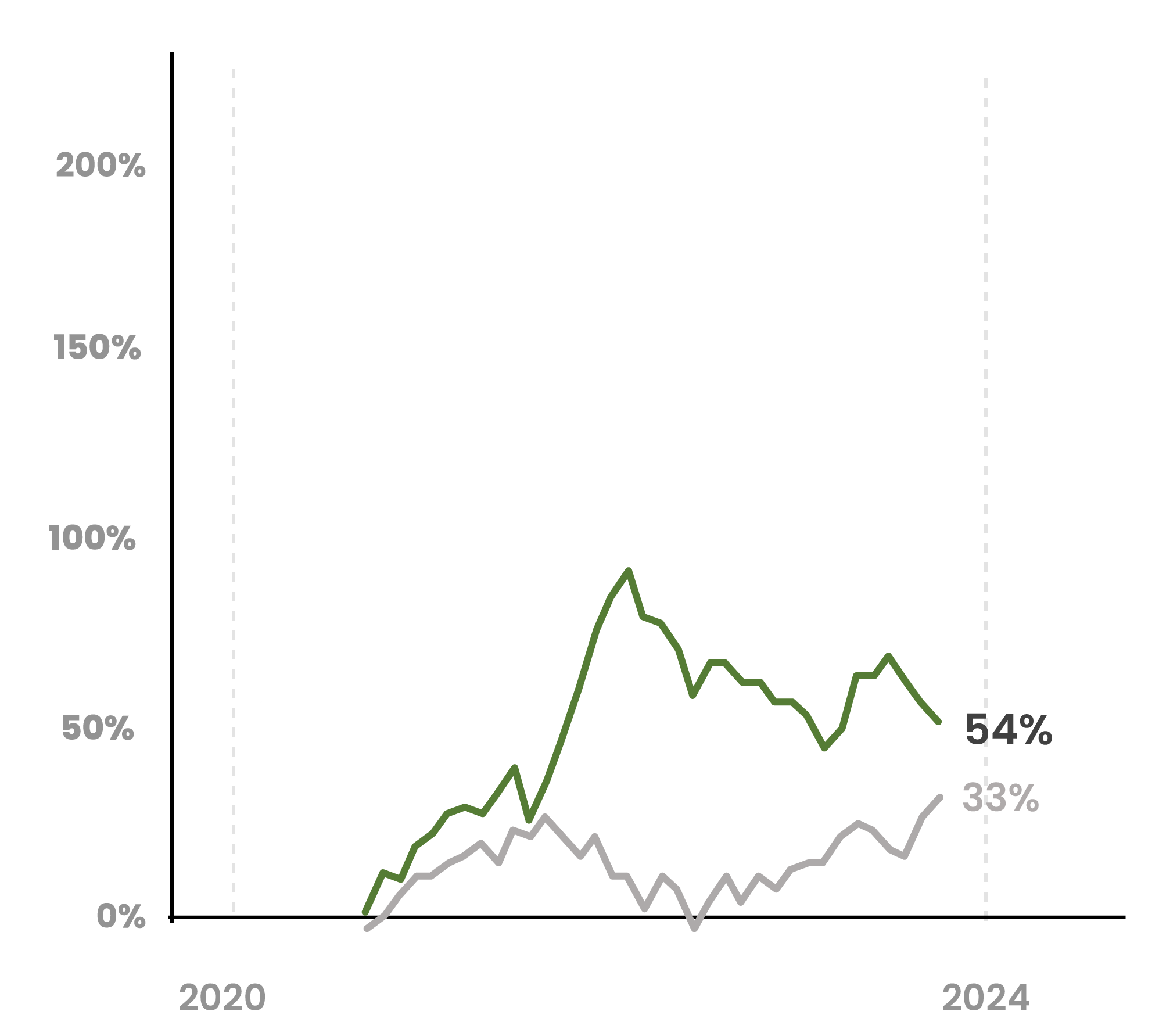

Themes drive markets over multi-year cycles

and outpace broader benchmarks.

Initially, market themes are typically characterized by attractive underlying fundamentals such as increasing revenues, healthy margins, and compelling valuations. They often gain momentum through a catalyst such as a breakthrough technology, macro regime shift, or recession and go unnoticed by the broader market at first. Their strong initial performance gradually builds a powerful narrative in the broader market that pushes the theme to greater highs. A theme’s multi-year upsurge often defines a decade’s market landscape.

At its peak, a market theme can appear infallible, with its demise seemingly unfathomable. However, history has repeatedly shown that a theme’s strong performance and the investment narrative developed around it eventually becomes detached from the underlying fundamentals, leading to unsustainable valuations. Such exuberance inevitably fades, in turn, guiding market attention towards the next theme—already in its nascency—and facilitating the "Boom” stage.

Market Theme History

1970s: Gold & Oil

Early Stage

Boom

The Fed’s subsequent dovish policy error led to inflation spiraling higher, pushing commodities, led by gold and oil, higher through that market cycle.

Decline

Gold and oil peaked in 1982, when Paul Volcker’s Fed raised interest rates to nosebleed levels, causing a severe recession, thereby ending the inflationary regime.

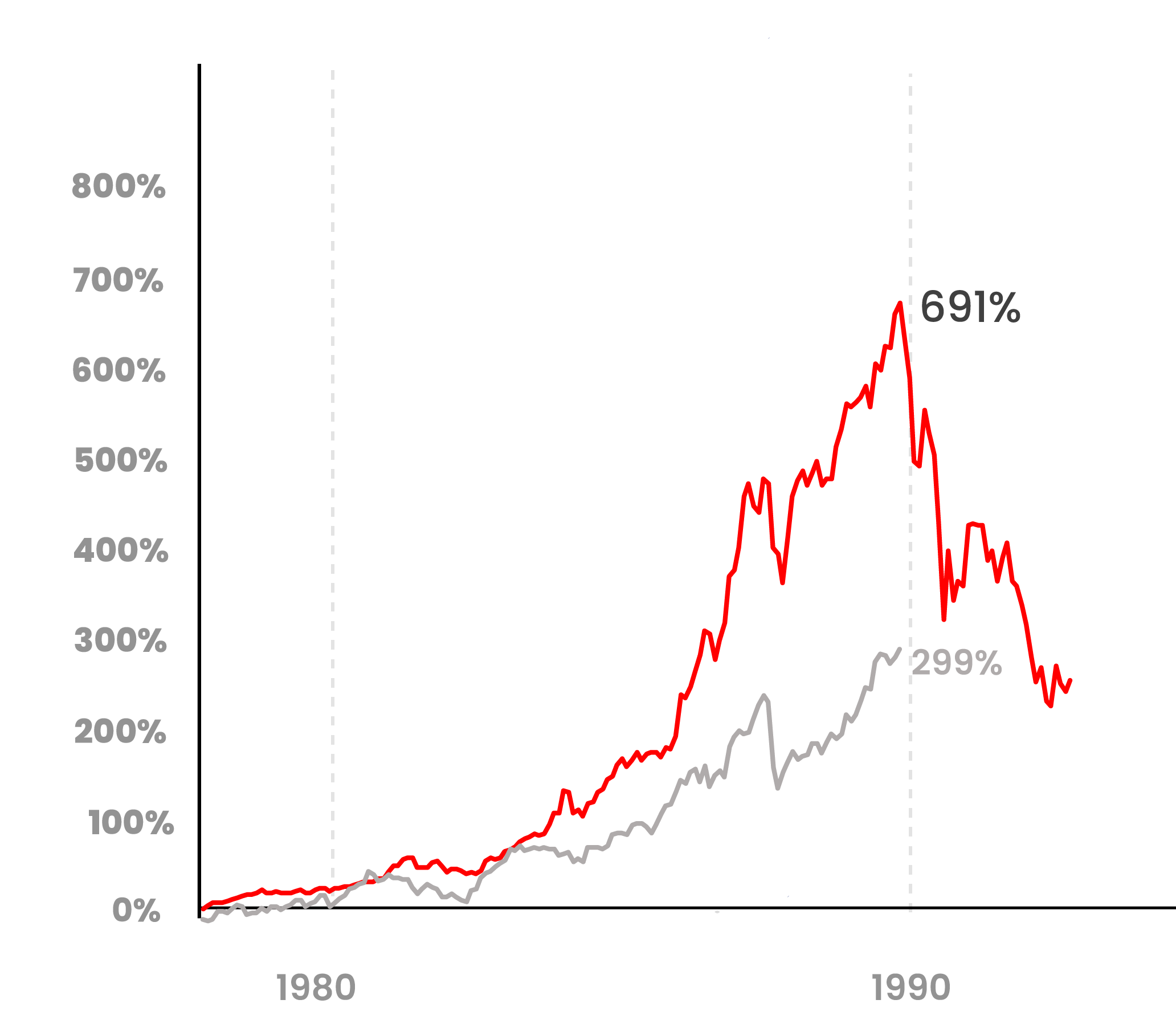

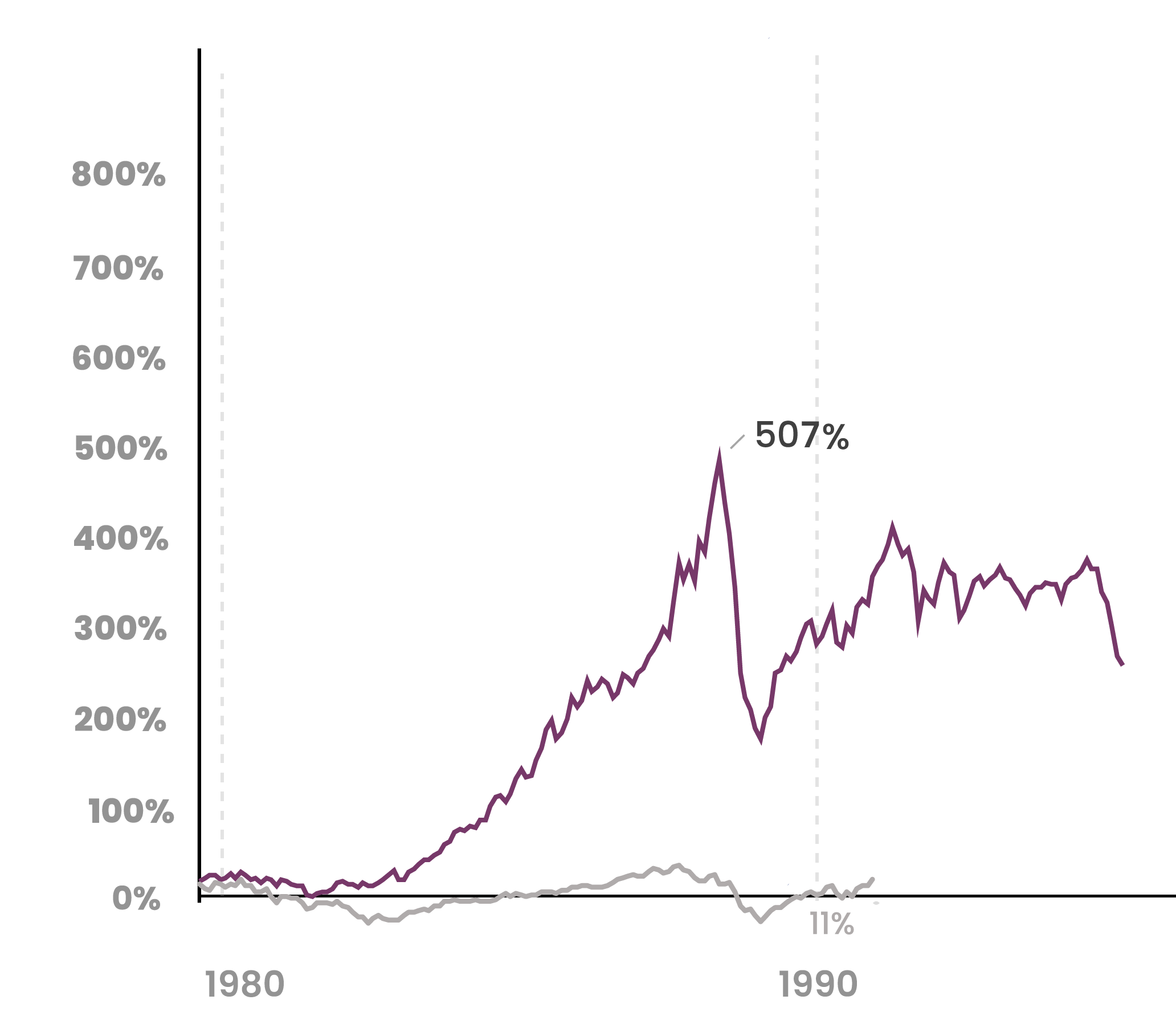

1980s - Japan

Early Stage

Japan’s post-war export economy got a boost in the 1970s from global demand for smaller, fuel-efficient cars and consumer electronics. Aided by a weak yen, this strong export growth continued in the 1980s, pushing Japanese equities higher.

Boom

The U.S. desire to reduce the dollar’s strength versus the yen and other trade partners led to the multi-national Plaza Accord to reduce the dollar’s strength in 1985. As a result, the yen strengthened, increasing the value of Japanese stocks and real estate. The Bank of Japan (BOJ) counterbalanced this yen strength with loose monetary policy to help Japanese exporters – unintentionally fueling the equity and real estate bull market higher.

Decline

By 1989, Japan’s growth narrative had become detached from the fundamentals of corporate earnings and valuations. The BOJ raised rates from 1989-1990 in response to the market frenzy, and by 1990, prices started imploding.

1990s – US Internet

Early Stage

The U.S. was undergoing a technology-driven productivity boom through new software tools powered by stronger computers and processing chips. 1993 saw the world’s first public web browser, and even though the Internet hadn’t yet caught the broader public’s imagination, the Nasdaq Index had quietly tripled by the end of 1995.

Boom

The internet bull market took off in earnest in the second half of the 1990s as investors benefitted from the confluence of 1) corporate spending on new software & hardware technology, 2) promising new internet e-commerce companies, 3) fiber optic and telecom infrastructure build-out spending 4) additional spending on Y2K bug concerns (remember that?). Furthermore, the Fed’s 1998 rate cuts in response to the Asian Financial Crisis and the Russian debt default added fuel to the tech bull market.

Decline

By 1999, the market’s “internet growth” narrative had ballooned to become detached from earnings growth, and valuations became stretched. The Fed began raising rates in June 1999, and by early 2000, the economy was beginning to show the effects, which also slowed the growth rates of tech companies. A series of earnings disappointments by mid-2000 were the precursor for the decline in U.S. tech and the broader market.

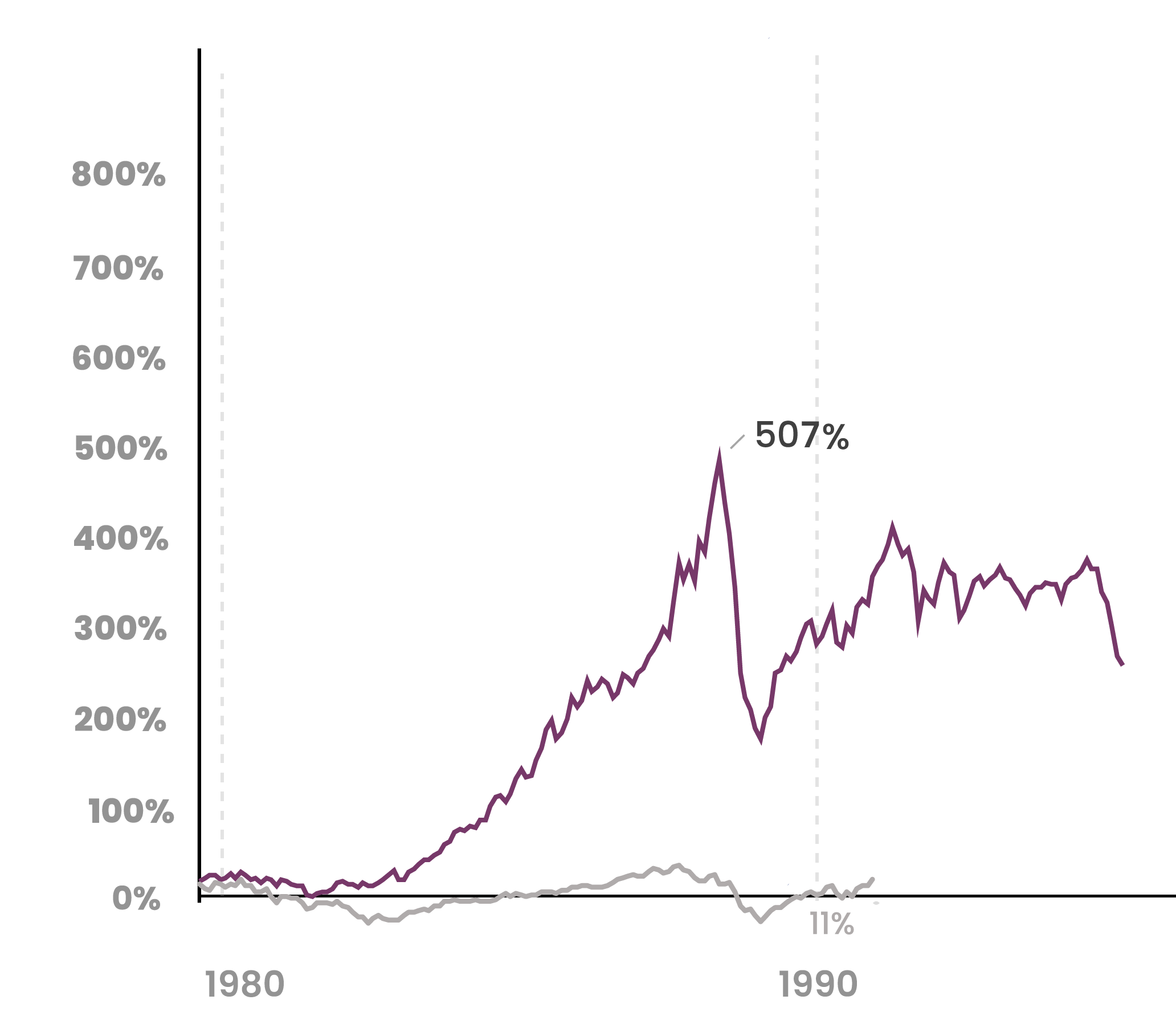

2000s – Emerging Markets & Commodities

Early Stage

China joined the World Trade Organization in 1999, while the U.S. Internet theme was peaking, setting the stage for the next theme of the 2000s.

Boom

The China-led Emerging Markets (EM) and commodity-themed bull market got underway in 2003, in the aftermath of the U.S.-led equity bear market of 2002-2003. China’s growth boom and the consequent commodities cycle were spurred by two primary factors: 1) China becoming the “factory of the world” as its low labor costs benefited from developed markets’ offshoring and 2) China’s voracious appetite for major commodities such as oil, copper, iron, etc. as it built its infrastructure to a scale and at a speed never seen before. Commodities started their bull run in 2002, and EM started theirs in the spring of 2003 when global equities bottomed out. EM and gold further benefited from additional liquidity when new ETFs gave a larger pool of investors access to those investments.

Decline

The rapid growth in EM was halted when the Great Financial Crisis (GFC) hit . While the U.S.’ and Europe’s response was monetary stimulus, China countered the crisis with a massive fiscal spending boost. This helped reflate the EM and commodities bull theme for a few more years until China reversed course in 2013 to broaden its economic model beyond infrastructure spending, ending that theme’s run.

2010s – US Tech

Early Stage

As China was seeing the limits of its fiscal stimulus in 2012, the U.S. Fed embarked on the third round of Quantitative Easing (QE) after two rounds in 2009 and 2010, respectively. By 2013, the U.S. economy and the financial markets were seeing sustained benefits from QE-induced liquidity. U.S. tech companies were connecting the world by bringing “the internet of everything” to life, especially in cloud computing and in mobile devices. They unleashed a global wave of technological transformation and saw their growth rates soar.

Boom

With anemic post-GFC global growth, the promise of strong secular growth among select tech companies, the near-zero cost of money, and investors facing few alternatives for return in traditional fixed income, combined to push investors up the risk curve. Investors’ animal spirits had been reignited as the Nasdaq 100 Index continued higher from strength to strength. The extremely low interest rates allowed venture capital investors to lead a new era of technology startups not seen since the 1990s – many of them to unicorn status ($1+ billion valuation). The Fed’s and the government’s double-barreled bazooka of monetary and fiscal stimulus during the Covid-19 pandemic helped push tech stock prices even higher – it also helped reawaken inflation from its disinflationary slumber.

Decline

The inflation shock and the Fed’s fight against it in 2022 initially hit the high growth, high valuation, tech stocks especially hard. While inflation has receded, it has not been vanquished and the high valuations of the U.S. tech and similar growth stocks remain vulnerable to the normalized interest rate era in our opinion. We remain confident that, while the U.S. Tech theme might retain its momentum for the remainder of 2024, we are closer to this theme’s end than to its renewal. History shows that each new market cycle is led by a different asset class or sector than the previous.

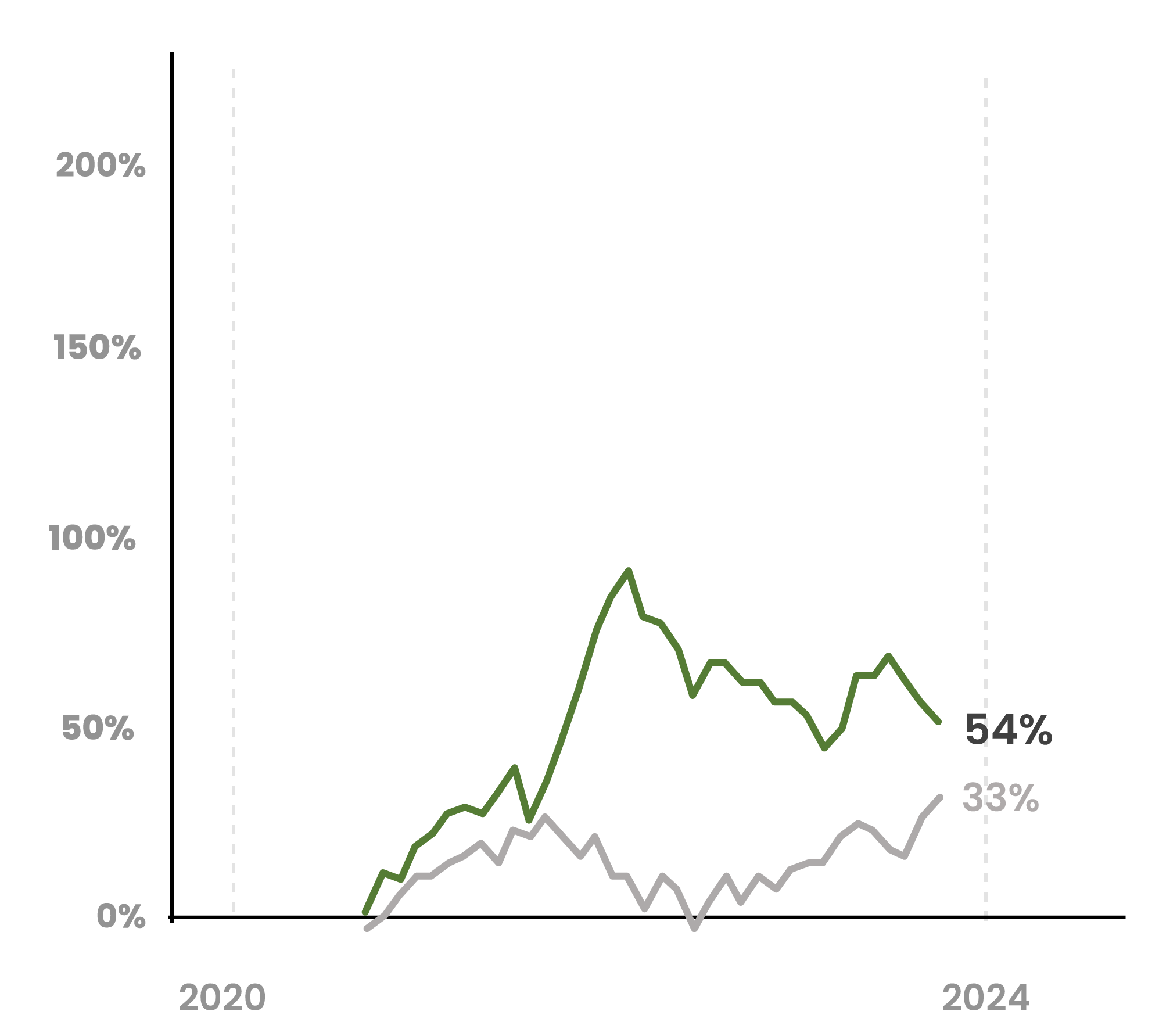

2020s – Return to Tangibles

Early Stage

In our view, 2021-2022 marked the beginning of the next market cycle which will be led by a commodity cycle. Our view is that this theme will be driven by the world’s growing appetite for not only life-sustaining but also economic-growth-enabling commodities. Every physical thing we consume and use originated from the ground, before industrial and agricultural processes transformed it into items for our consumption. The market consensus belief of a post-commodity world where our virtual and detached existence wouldn’t need the dirty physical materials was rudely awakened by the supply-, inflation- and geopolitical shocks of 2021-2022. These shocks were the genesis and triggered the early stages of this theme. Our view also remains that inflation hasn’t had its last laugh yet, and will likely resurface, as stubbornly persistent energy prices and sticky wages could keep it alive.

Outlook

Our view is that the long, boom phase will start once the central banks, led by the Fed embark on easing monetary policy. Whether prematurely as they did in the 1970s or having successfully subdued inflation through a recession similar to the early 2000s, commodity prices seem to be a beach ball that’s being held down under the water by the Fed’s tightening cycle. Once that cycle ends, we expect commodities to be off to the races. Just as in the prior cycles, our view is that the next market cycle will likely last for multiple years and continue to evolve and shift through various sub-themes, such as increasing demand for oil and gas, the growing copper demand to feed infrastructure as well as technology needs, the importance of gold in the face of geopolitical- or fiscal budget shocks, to the increasing demand for uranium as nuclear power regains in popularity.