1972 Market Partying Like It’s 1999

Bottom Line Upfront: 2024’s market rally, driven by A.I.-fueled momentum and lofty valuations, evokes parallels to past inflection points in market history, especially the Nifty Fifty era of the 1970s and the dot-com bubble of the late 1990s. Likewise, the macro environment suggests a precarious backdrop, setting the stage for a potential inflationary boom that drags down current market leadership and shifts growth to tangible sectors.

- The post-U.S. election market run has been stunning. Indexes are up, Tech’s Artificial Intelligence (A.I.) rally continues, despite some mixed recent earnings results, crypto is on fire with bitcoin hitting record values. All-time highs abound.

- It is the strongest momentum market in years, being chased by professional and retail investors alike.

- Some are calling the A.I.-centered boom that’s leading this momentum rally another 1995 moment, a reference to the year when the internet captured investors’ imaginations and set the stage for a 5-year tech bull market for the ages.

- As tempting as that comparison is in capturing the market moment, it ignores the realities of the vastly different macroeconomic backdrop from the 1990s—especially of inflation and interest rates, which are driven by employment, the fiscal debt environment, as well as monetary and fiscal policy.

- Rather, U.S. equity markets resemble a combination of 1972 and 1999, both years nearing historical market inflection points and ones marking the beginning of market leadership change.

- Of course, the timing may be imprecise and careful risk management is required, as the adage “Markets can stay irrational longer than you can stay solvent.” is apt.

1972 Market Partying Like It’s 1999

Bottom Line Upfront: 2024’s market rally, driven by A.I.-fueled momentum and lofty valuations, evokes parallels to past inflection points in market history, especially the Nifty Fifty era of the 1970s and the dot-com bubble of the late 1990s. Likewise, the macro environment suggests a precarious backdrop, setting the stage for a potential inflationary boom that drags down current market leadership and shifts growth to tangible sectors.

- The post-U.S. election market run has been stunning. Indexes are up, Tech’s Artificial Intelligence (A.I.) rally continues, despite some mixed recent earnings results, crypto is on fire with bitcoin hitting record values. All-time highs abound.

- It is the strongest momentum market in years, being chased by professional and retail investors alike.

- Some are calling the A.I.-centered boom that’s leading this momentum rally another 1995 moment, a reference to the year when the internet captured investors’ imaginations and set the stage for a 5-year tech bull market for the ages.

- As tempting as that comparison is in capturing the market moment, it ignores the realities of the vastly different macroeconomic backdrop from the 1990s—especially of inflation and interest rates, which are driven by employment, the fiscal debt environment, as well as monetary and fiscal policy.

- Rather, U.S. equity markets resemble a combination of 1972 and 1999, both years nearing historical market inflection points and ones marking the beginning of market leadership change.

- Of course, the timing may be imprecise and careful risk management is required, as the adage “Markets can stay irrational longer than you can stay solvent.” is apt.

Source: Sarmaya Partners, Macrobond

1972

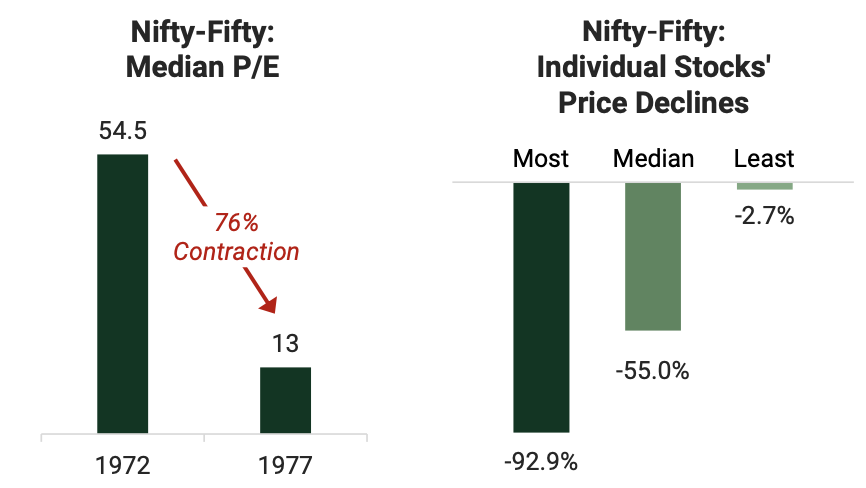

A small grouping of companies—the Nifty-Fifty stocks of the late 1960s—were considered rock-solid and were the leaders in customer reach through conglomeration, their footprints ever-growing, and their stock prices dominating the market.

Yet they weren’t infallible. The ensuing years revealed that they:

- Had been the beneficiaries of Fed easy money policies and

- Were equally susceptible to the vagaries of inflation, rising rates and the inevitable gyrations of the business cycle as many other businesses in history.

In the years after peaking around 1972, the Nifty Fifty stocks declined significantly as they made way for the next market theme: a commodity super cycle led by gold and oil. The price decline of the median Nifty Fifty stock was

-55%, while the best and the worst performers dropped -2.7% and -93%, respectively.

Source: Forbes – 12/15/1977; Price Declines: Drawdown from High between 1972-1977 until 12/1977

Drawing Parallels With Today’s Market

While the “Magnificent 7” (Mag 7) stocks are only 7 companies, they represent a disproportionately large part of the market (>30% of the S&P 500’s current market cap) AND they are arguably behemoth global monopolies in their respective core businesses.

- They’re seen as high-quality companies that will maintain their elevated growth rates in perpetuity as the world continues to march towards more technological disruption and adoption. Their reign seems infallible and their decline in stature and relevance unfathomable.

However, like the Nifty-Fifty, the Mag 7 companies are not immune to the ups and downs of business and market cycles. Yes, they may have strong balance sheets and hordes of cash, but investors haven’t been chasing up their stocks because of those attributes.

- Their stocks have rocketed higher due to their earnings growth rates, as seen in their high stock multiples. Rising interest rates on the back of resurgent inflation and slowing earnings growth will likely act as the Kryptonite they always have for businesses, and the Mag 7 are no different.

1999

The bull market of the late ’90s, driven by the tech stock speculative craze, that peaked in early 2000 is well known as one of the biggest bubbles in U.S. equity market history (“dot-com bubble”).

- After peaking in March 2000, the tech-heavy Nasdaq Composite index declined by almost 80% and the S&P 500 index declined by almost 43% in a slow-bleed bear market that lasted for over two and a half years.

- During this decline the Fed continued to cut rates to no avail. These companies’ earnings growth couldn’t return to their previous highs and investor sentiment shifted, leading to a market of multiple compression.

The tangible sectors such as energy and materials remained flat to positive during most of this bear market given the margin of safety their starting valuations and growth prospects afforded them. They ultimately declined by 15% and 11% respectively during that same period.

- The ensuing market recovery and bull market was led by the tangible sectors and Emerging Markets as the growth had shifted to those areas of the market.

Expect Energy to Hold Up Better in Market Decline

Source: Sarmaya Partners, Macrobond; rebased to 100 (dot-com bubble peak – trough)

Drawing Parallels With Today’s Market

There are echoes of the dot-com boom in the current market, though it isn’t an exact reenactment of that era. The clearest similarity is the lofty valuations the current A.I. boom names are commanding, representing the high expectations of stellar future growth. And therein lies the rub. As long as the significant RATE of growth can keep up, the high valuations will remain sticky, and thereby, their stock prices.

However, high growth rates cannot remain high forever. And when the current growth of these tech giants inevitably slows, their prices will likely decline.

- Growth investors in these names are playing a game of hot potato and will drop them as soon as the growth rate declines sequentially. This has happened before, and it will happen again.

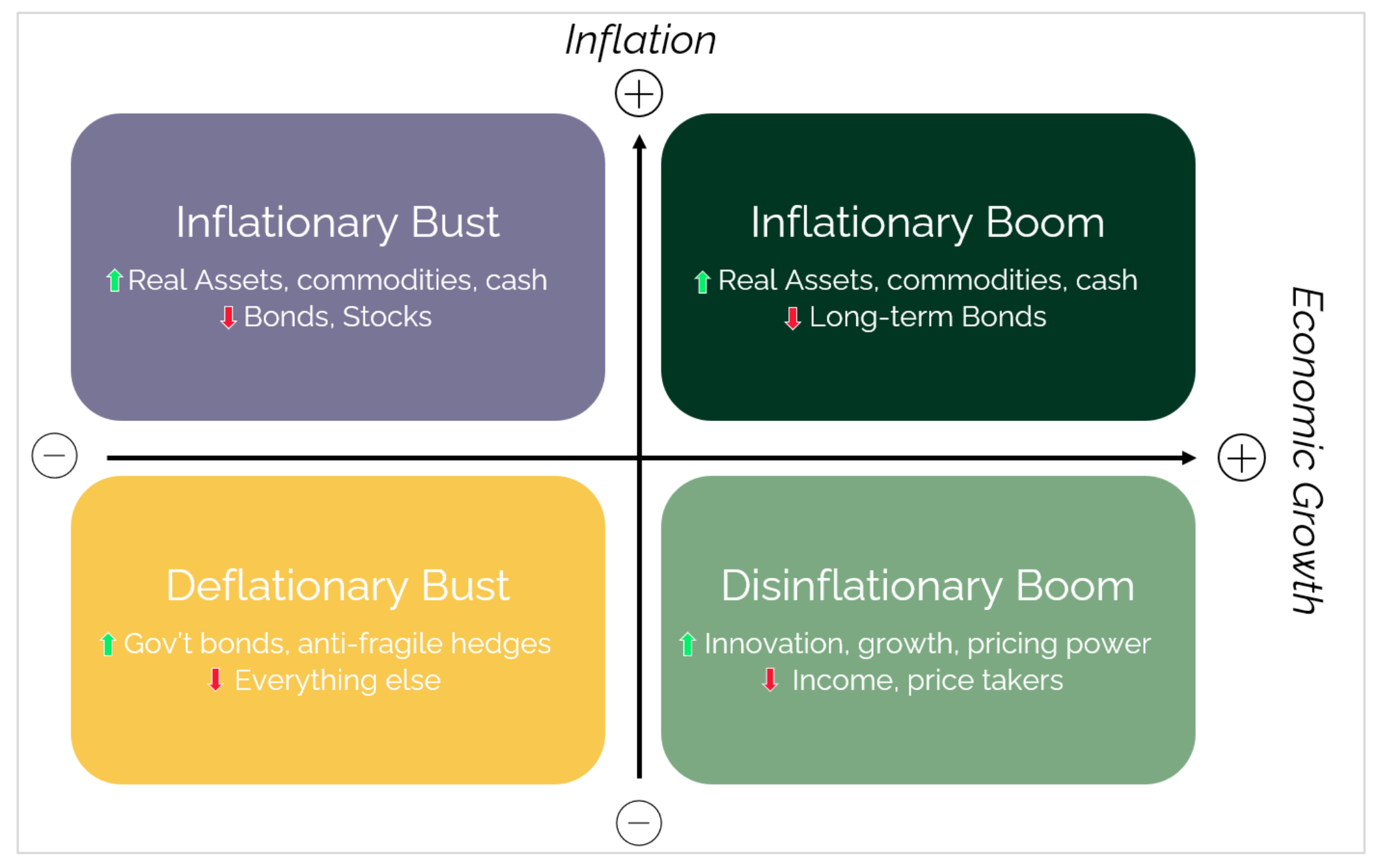

Today: That ’70s Show Meets The 2000s

History may not repeat itself, but the next market cycle may rhyme with a combination of the 1970s and the 2000s. The ’70s experienced a stagflationary bust and the 2000s saw a growth boom. Both eras saw real assets and commodities rise – the former due to inflation and the latter due to strong demand.

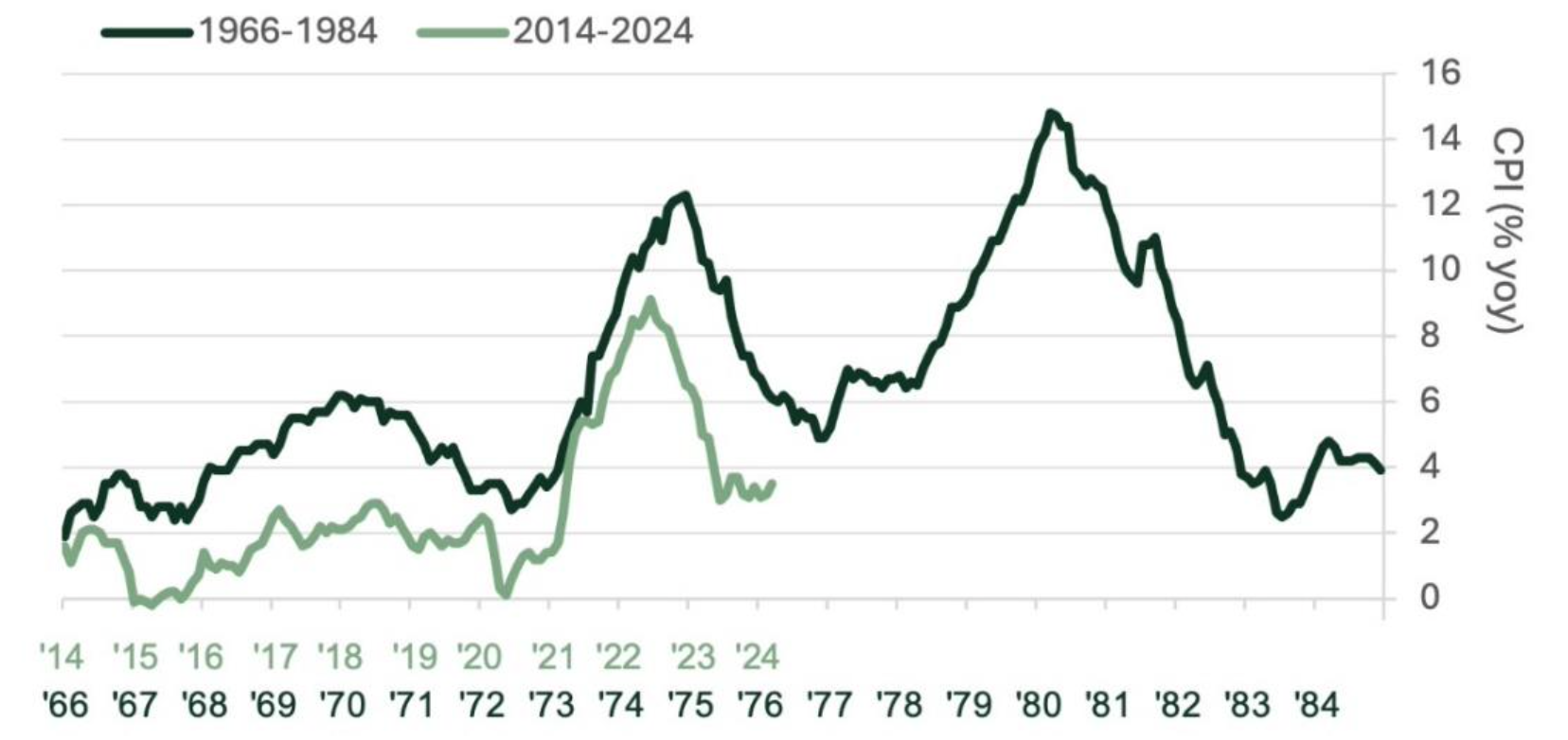

Like in the ’70s, inflation is likely to return, as:

- The Powell Fed is cutting rates amid a resilient, strong job and financial market, and

- The incoming administration’s pro-growth policies to rebuild American industry while raising tariffs and deporting undocumented immigrants are likely to be inflationary.

Current Inflation Pattern Reminiscent of the 1970s

Source: Apollo, Bloomberg

The 2000s saw a global growth boom led by China that pushed demand for goods and all commodities higher, especially oil and gold.

- Now the U.S. finds itself on the starting line of an industrial renaissance what will require large amounts of capacity build out.

- Add to this the continual growth from the other Asian countries, led by India, and we have the ingredients of another global growth boom.

Thus, the setup for an inflationary boom is a high probability scenario over the next major market cycle.

- When the growth in tech slows, and it eventually will, investors will seek out new growth. And that will likely be in the tangible sectors and areas that benefit from real asset appreciation, such as commodities.

Source: Sarmaya Partners

Disclaimers

The content herein is intended for informational and educational purposes only. The content presented herein should not be considered investment advice, the basis for investment decisions, or a source of legal, tax, or accounting guidance. Investment markets inherently carry risks, and investment outcomes may deviate from initial investments. This does not constitute an offer to sell or solicit the purchase of units or shares in any product.

Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Sarmaya Partners or the respective third party. They do not constitute endorsements or investment recommendations to buy, sell, or hold any security.

Some statements herein may express future expectations and forward-looking views based on Sarmaya Partners’ current assumptions. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

© 2024 Sarmaya Partners, LLC

December 3, 2024